问题如下:

An investment bank that underwrites a bond issue most likely:

选项:

A.buys and resells the newly issued bonds to investors or dealers.

B.acts as a broker and receives a commission for selling the bonds to investors.

C.incurs less risk associated with selling the bonds than in a best efforts offering.

解释:

A is correct.

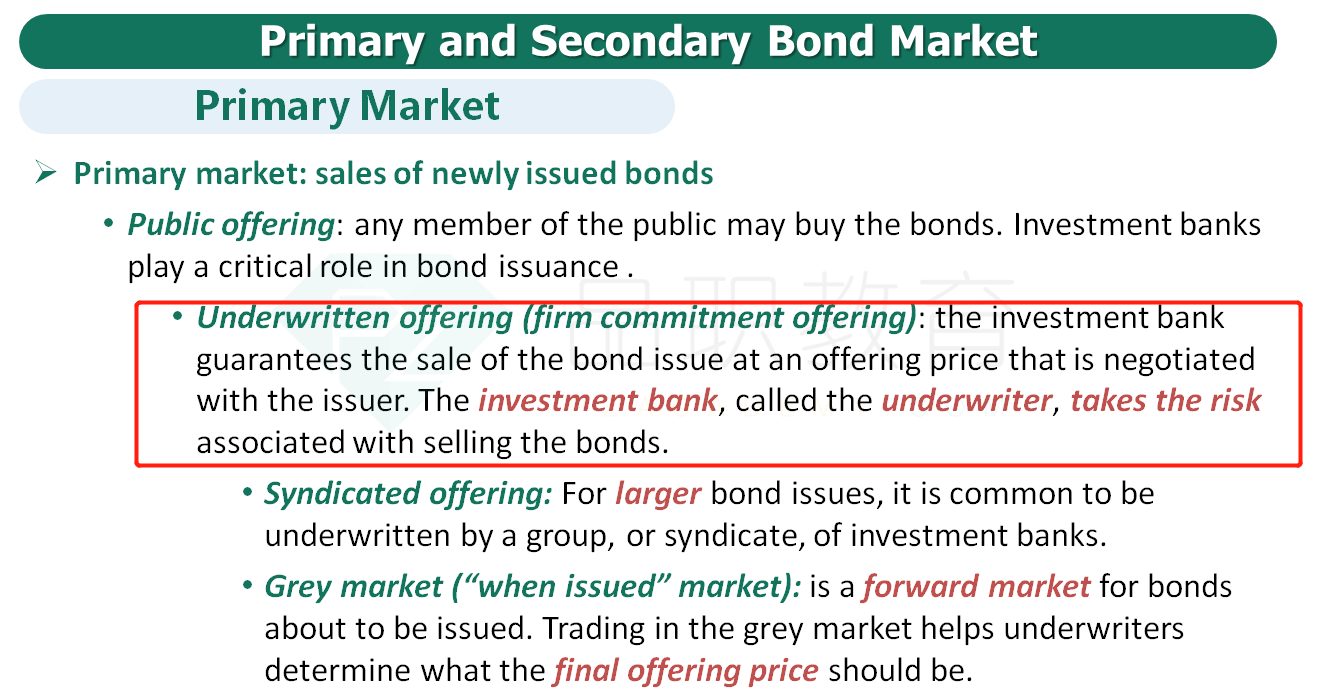

In an underwritten offering (also called firm commitment offering), the investment bank (called the underwriter) guarantees the sale of the bond issue at an offering price that is negotiated with the issuer. Thus, the underwriter takes the risk of buying the newly issued bonds from the issuer, and then reselling them to investors or to dealers who then sell them to investors. B and C are incorrect because the bond issuing mechanism where an investment bank acts as a broker and receives a commission for selling the bonds to investors, and incurs less risk associated with selling the bonds, is a best efforts offering (not an underwritten offering).

C选项涉及到的风险大小比较,似乎在讲义里没有提到

这个风险怎么比较呢?

我自己的理解是,包销风险更大,因为全部都自己吃进了,卖不掉烂在手里就是成本,而 best effort 是有多少卖多少,风险按说应该比包销小啊?所以 C 说反了是吧?