The Epsilon Institute of Theoretical Physics is a non-profit corporation initially funded from government and private sources. Mitch Lazare is the chairman of the Investment Committee, which oversees the institute’s endowment fund, of which about $750 million is currently under active management. He is currently tasked with finding two additional investment managers to manage a portion of the actively managed funds and, along with his assistant, Brian Warrack, is reviewing the presentations made by several applicants.

John Fraser’s performance is the first that Lazare and Warrack review. Fraser’s fund is constructed with a discretionary approach using the four Fama–French factors; he uses the Russell 1000 Value Index as his benchmark. The most recent 10 years of performance data for both the fund and the benchmark are shown in Exhibit 1.

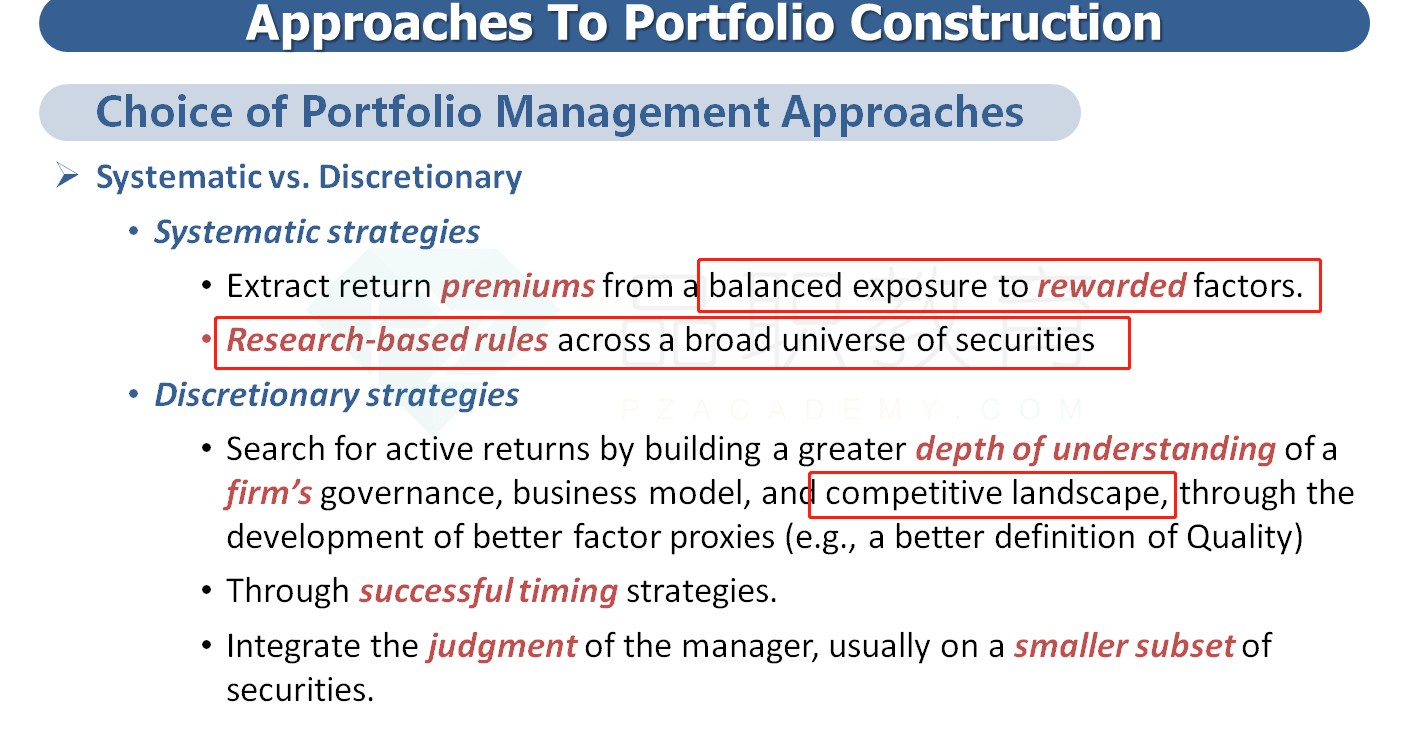

Q. The investment process indicated for the Fraser Fund is most likely designed around which of the following?

- A balanced exposure to known rewarded factors

- Research-based rules across a broad universe of securities

- The inclusion of non-financial variables, such as pricing power

C is correct. The discretionary investment process searches for active returns from firm-specific factors, such as pricing power and the competitive landscape. This process results in more concentrated portfolios reflecting the depth of the manager’s insights on firm characteristics and the competitive landscape.