问题如下:

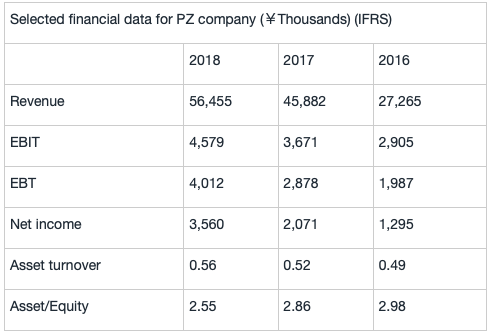

Analyst collected the financial information about PZ company in the following table:

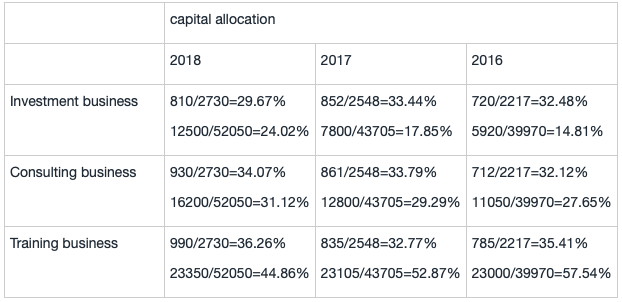

PZ’s segment information is in the following table:

PZ’s segment EBIT margins in 2018 were 15% for Investment business, 9% for Consulting business and 12% for Training business.

Based on the Dupont analysis, analyst believes the firm could increase the ROE if the company divested segments that were generating the lowest returns on capital employed, the business segment best suited for divestiture is:

选项:

A. Investment business

B. Consulting business

C. Training business

解释:

B is correct.

考点:capital allocation

解析:

可以直接观察 CapEx%和Assets%,如果前者大于后者,说明在加速投资,三个部门中,investment和consulting都在加速投资,但是consulting的EBITmargin最低,是9%,所以应该剔除该部门。

题目说的很清楚以ROCE为标准来判断剔除哪个部门,但题目条件不够算出来每个部门的ROCE。像之前有同学说了,这个剔除与否和前几年是否加速投资没有必然关系。总觉得这道题出的不大舒服,不够strightforward