问题如下:

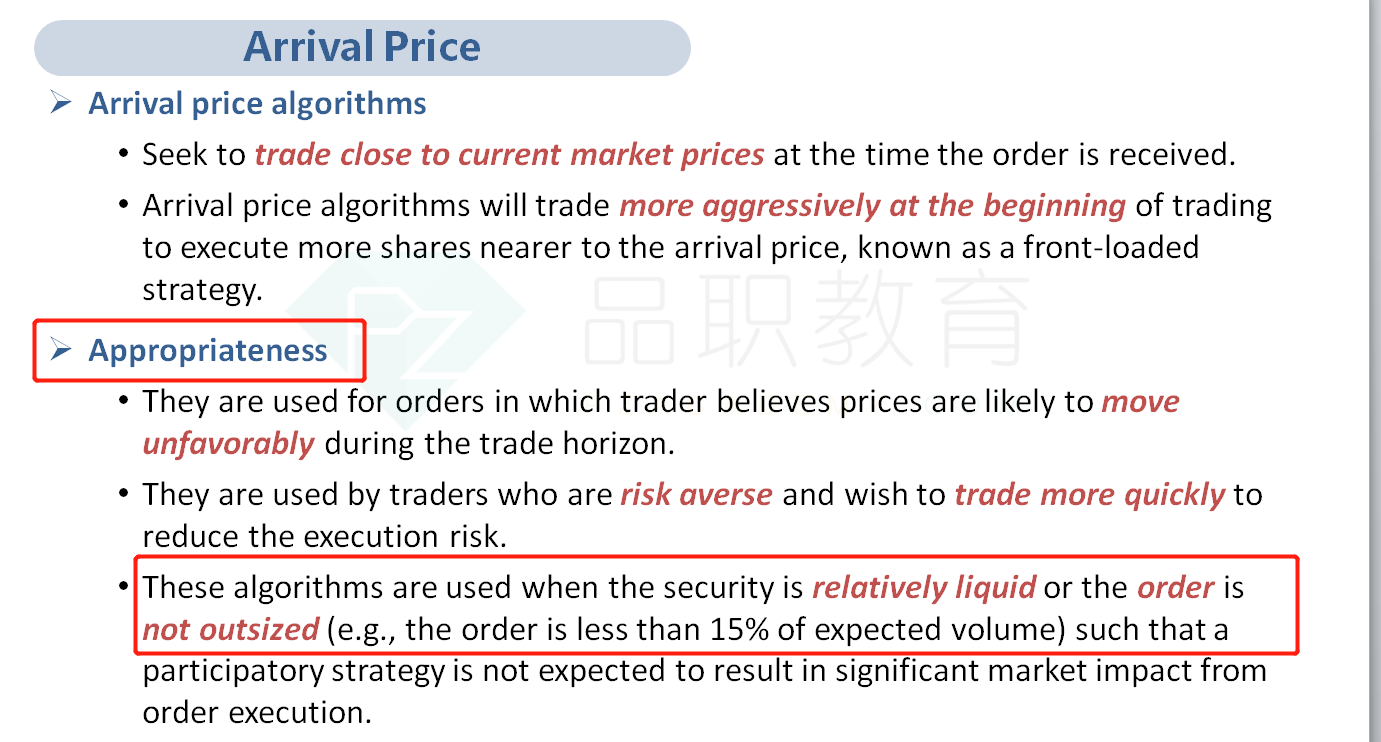

Right after the earnings announcement, the pre-market price of ABC was $75. Concerned that the underreaction would be short-lived, Harding directed Yellow to buy 30,000 shares of ABC stock. Yellow and Harding discussed a trading strategy, knowing that ABC shares are very liquid and the order would represent only about 1% of the expected daily volume. They agreed on trading a portion of the order at the opening auction and then filling the remainder of the order after the opening auction. The strategy for filling the remaining portion of the order was to execute trades at prices close to the market price at the time the order was received.

To fill the remaining portion of the ABC order, Yellow is using:

选项:

A. an arrival price trading strategy.

B. a TWAP participation strategy.

C. a VWAP participation strategy.

解释:

A is correct.

Given the trade urgency of the order, the very liquid market for ABC shares, and the small order size relative to ABC’s expected volume, Yellow is using an arrival price trading strategy that would attempt to execute the remaining shares close to market prices at the time the order is received.

请问题目中给出的流动性很好交易量小之类的条件有什么作用吗?和选择arrival price作为benchmark有关系吗?是不是废条件?