问题如下:

Foresight International Assurance is an international multiline insurance conglomerate. Under its overall strategic financial plan, it computes the annualized standard deviation of returns on investment assets as 5.0% and on liabilities as 2.5%. The bulk of its liabilities are constituted by the net present value of expected claims payouts. The correlation between asset and liability returns is therefore a very low 0.25. Foresight’s common equity to financial assets ratio is 20.0%.

What is the standard deviation of changes in the value of Foresight’s shareholder capitalization?

选项:

解释:

We use Equation 9 recognizing that A ÷ E = 1/0.20 = 5; (A ÷ E) –1 = 4; the standard deviation of asset returns ( σ∆A/A) = 0.05; the standard deviation of changes in liability values ( σ∆L/L) = 0.025; and the correlation between asset and liability value changes (ρ)= 0.25.

First, we compute the variance of shareholders’ capital value changes:

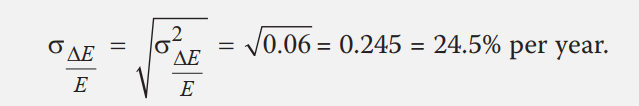

The standard deviation of shareholder capital valuation change is the square root of the variance. Thus,

老师好!请问【standard deviation of asset returns】=【( σ∆A/A) 】 吗?不应该是【standard deviation of asset returns】=【( σA) 】吗?