问题如下:

If the correlation between foreign-currency asset returns and movements in the exchange rate is increasing, the expected domestic-currency returns will:

选项:

A.increase

B.decrease

C.unchange.

解释:

C is correct.

考点:Currency Risk & Portfolio Return and Risk

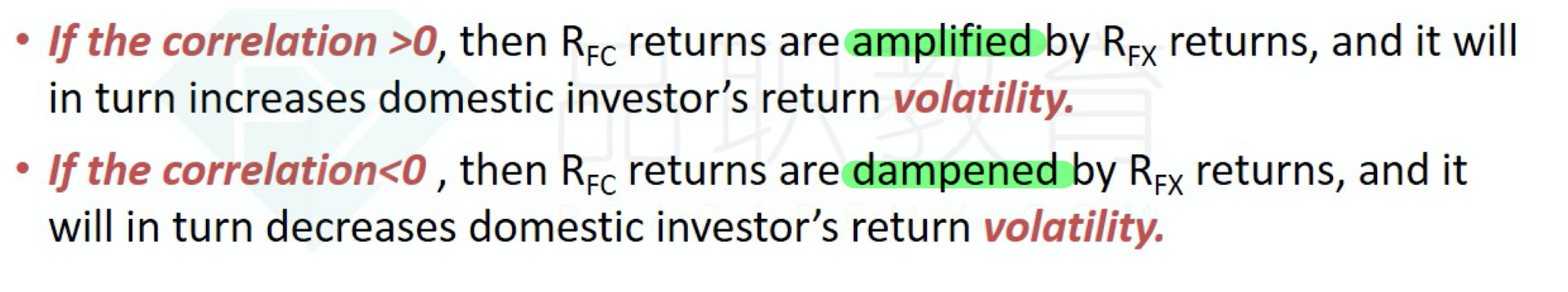

解析:correlation的增加会影响domestic-currency risk,而不会影响returns。写出公式就能理解了:

,

老师好 基础班这两词如何翻译和理解?