问题如下:

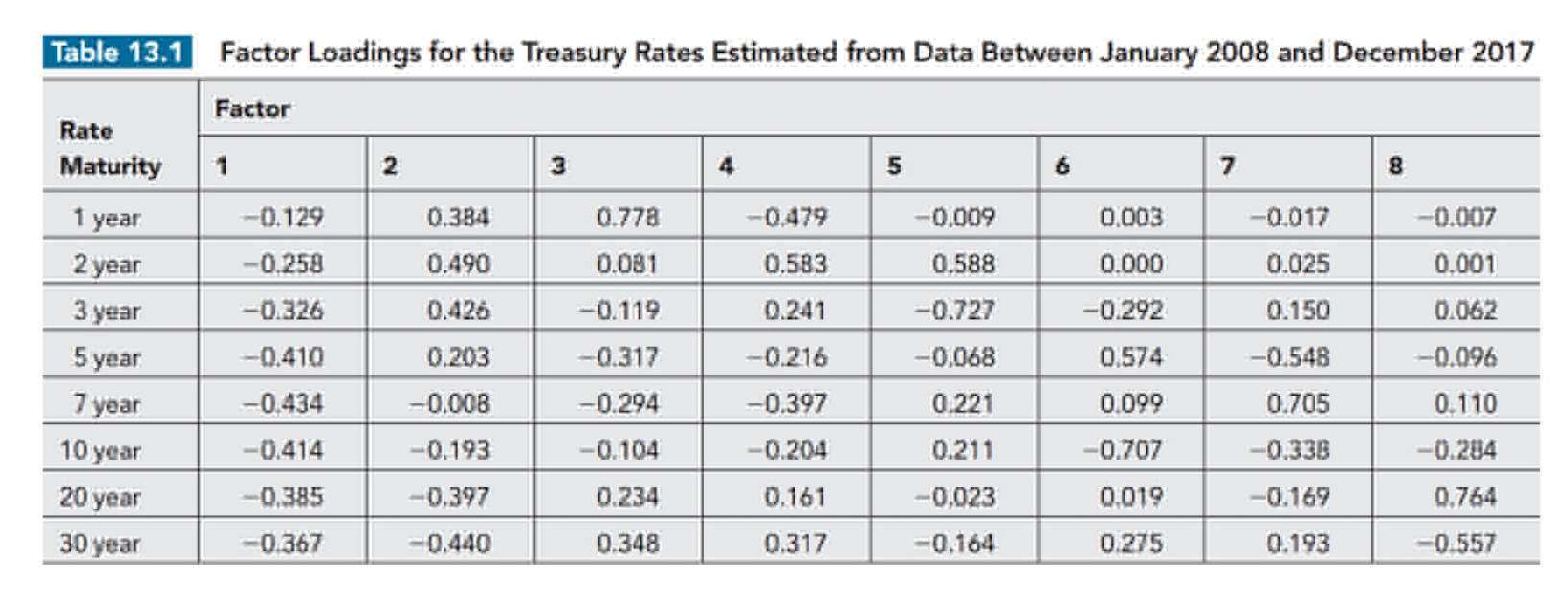

Suppose a portfolio has an exposure of +50 to a one-basis-point increase in the five-year Treasury rate in Table13.1, an exposure of −100 to a one-basis-point increase in the ten-year Treasury rate in Table 13.1, and no other exposures. What is the portfolio’s exposure to the first two factors in Table 13.1?

解释:

The exposure to one unit of the first factor is

50 × (−0.410) − 100 × (−0.414) = 20.9

The exposure to one unit of the second factor is

50 × 0.203 − 100 ×

(−0.193) = 29.45