问题如下:

On January 15 of Year 1, a company decides to hedge the purchase of 100,000 bushels of corn on February 15 of Year 2. The following table gives futures prices (cents per bushel) of three selected contracts on four different dates. Explain how the company can use the contracts to create the required hedge. What is the net (after hedging) price paid for the corn as a function of the spot price on Febru-ary 15 of Year 2? Each corn contract is on 5,000 bushels.

选项:

解释:

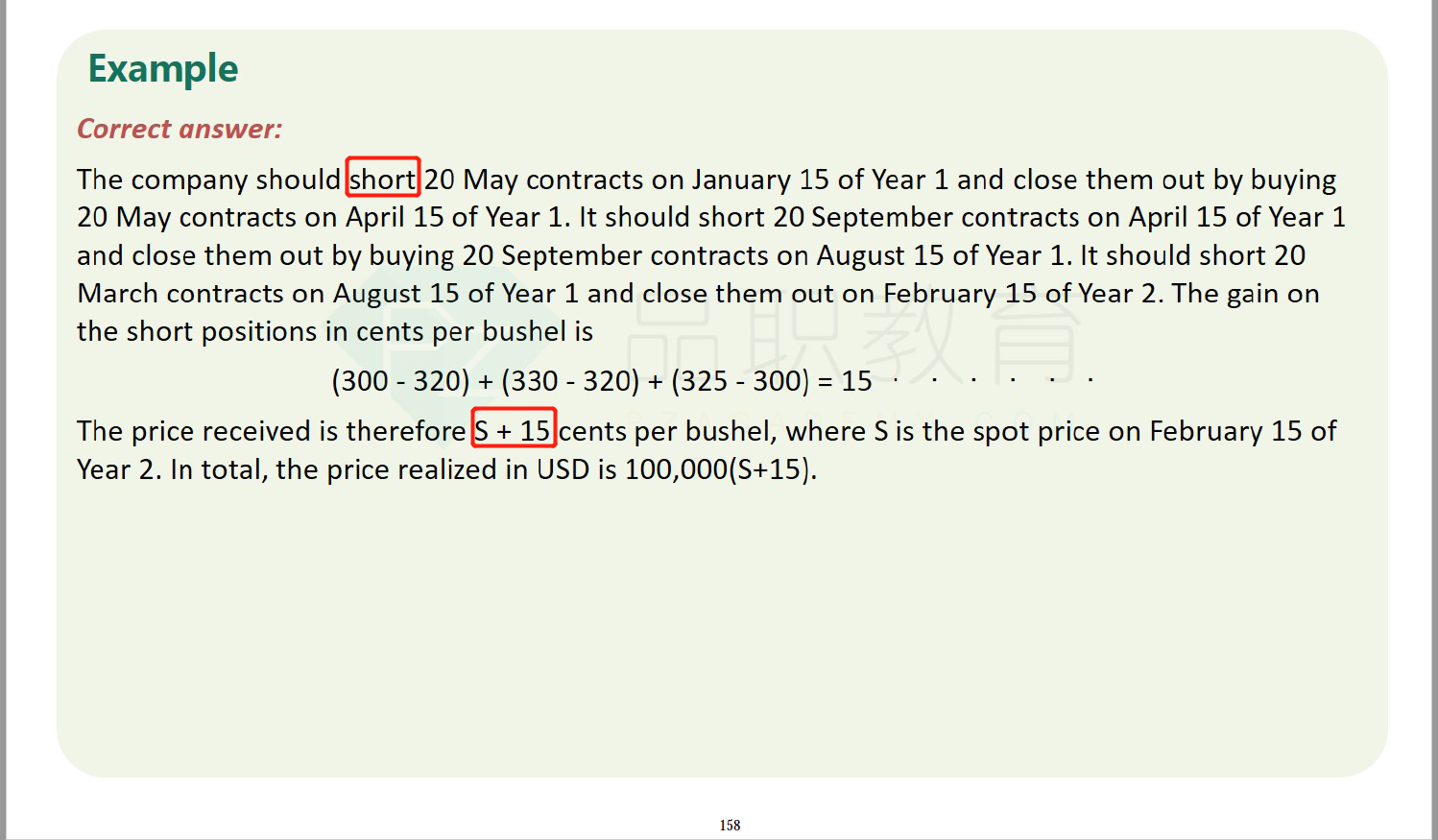

The company should short 20 May contracts on January 15 of Year 1 and close them out by buying 20 May contracts on April 15 of Year 1. It should short 20 September contracts on April 15 of Year 1 and close them out by buying 20 September contracts on August 15 of Year 1. It should short 20 March contracts on August 15 of Year 1 and close them out on February 15 of Year 2. The gain on the short positions in cents per bushel is

(300 - 320) + (330 - 320) + (325 - 300) = 15

The price paid is therefore S - 15 cents per bushel, where S is the spot price on February 15 of Year 2. In total, the cost in USD is 1,000(S-15).

请问这个题是hedge the purchase 那我是担心价格变高 我的hedge应该是long 而不是答案给的short呀