问题如下:

XYZ Hedge Fund wants to get exposure to a high-yield pool of commercial loans without actually investing in the loans. It wants a leverage ratio of7.5. If the hedge fund is willing to invest $35 million in this investment, which credit derivative is best for them and what is their expected return given that the reference asset earns LIBOR plus 285 basis points, the counterparty earns LIBOR plus 150 basis points, and the required collateral earns 3.5%?

选项: Total return swap with a 13.63%

return.

Asset-backed credit-linked note with an 11.34% return.

C.Total return swap with an 11.34% return.

D.Asset-backed credit-linked note with a 13.63% return.

解释:

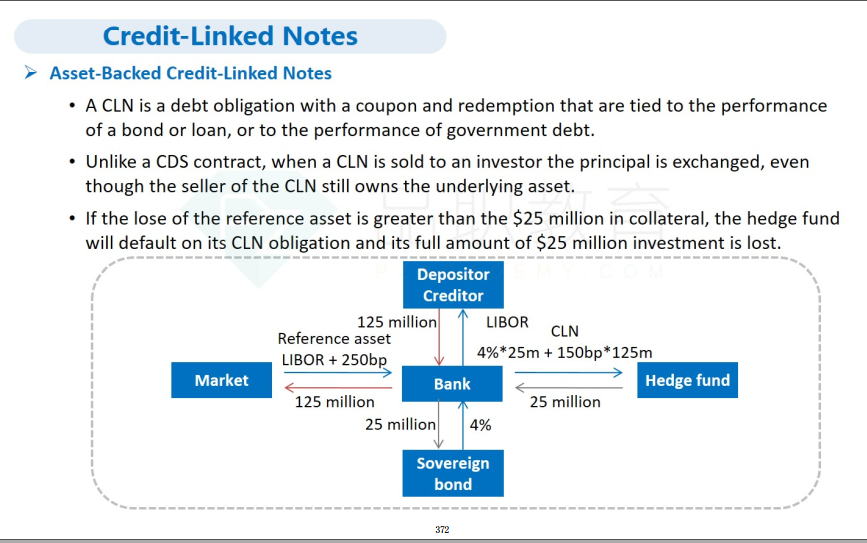

D The best credit derivative for this hedge fund is an asset-backed credit-linked note. With leverage of7.5 and an investment of $35 million, we know that the notional value of the pool of commercial loans is $262.5 million. The hedge fund will earn 3.5% on their $35 million in collateral. This translates into $1.225 million. They will also earn the 135 basis point spread on the entire $262.5 million. This translates into $3.54375 million. The hedge fund’s percentage return is 13.63% [($1.225 million + $3.54375 million) / $35 million]).

这里的counterparty指的是帮Hedge Fund做杠杆的一方是么