问题如下:

Based on Exhibit 1 and assuming Tyo’s market views on yield curve changes are realized, the forward curve of which country will lie below its spot curve?

选项:

A.Country A

B.Country B

C.Country C

解释:

B is correct.

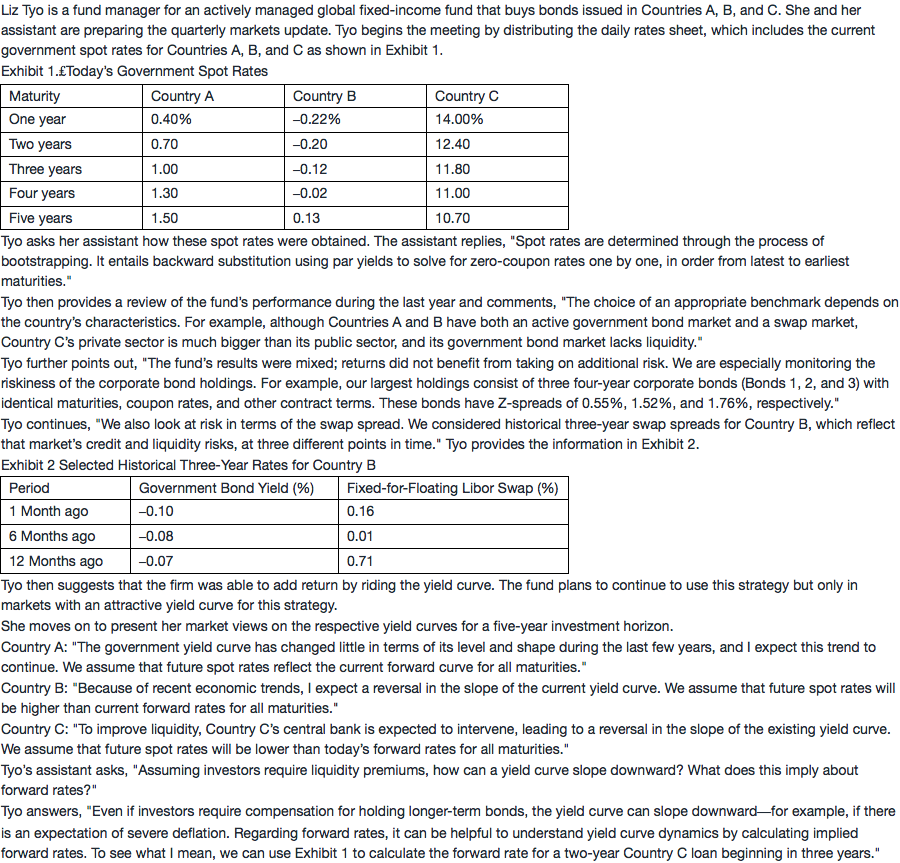

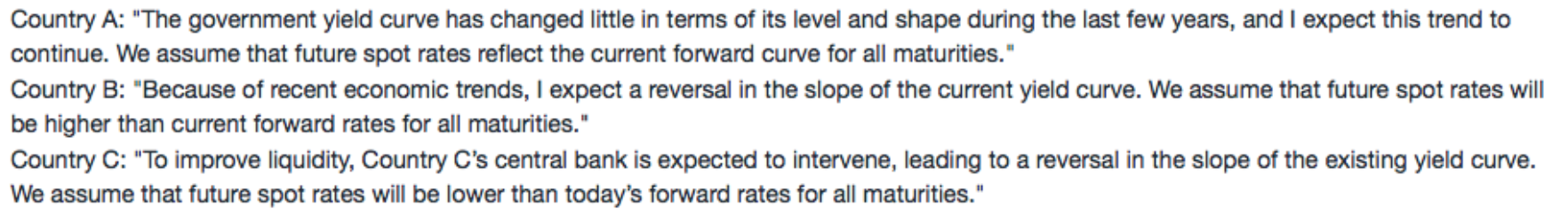

The yield curve for Country B is currently upward sloping, but Tyo expects a reversal in the slope of the current yield curve. This means she expects the resulting yield curve for Country B to slope downward, which implies that the resulting forward curve would lie below the spot yield curve. The forward curve lies below the spot curve in scenarios in which the spot curve is downward sloping;the forward curve lies above the spot curve in scenarios in which the spot curve is upward sloping.

A is incorrect because the yield curve for Country A is currently upward sloping and Tyo expects that the yield curve will maintain its shape and level. That expectation implies that the resulting forward curve would be above the spot yield curve.

C is incorrect because the yield curve for Country C is currently downward sloping and Tyo expects a reversal in the slope of the current yield curve. This means she expects the resulting yield curve for Country C to slope upward, which implies that the resulting forward curve would be above the spot yield curve.

A国的收益率曲线也是向上倾斜,和B国的区别是?

同学你好,这一题是根据第一个表和这三句话得出的选B,A国家和B国家本来都是upward sloping 但B国家的曲线翻转过来了。

同学你好,这一题是根据第一个表和这三句话得出的选B,A国家和B国家本来都是upward sloping 但B国家的曲线翻转过来了。