问题如下:

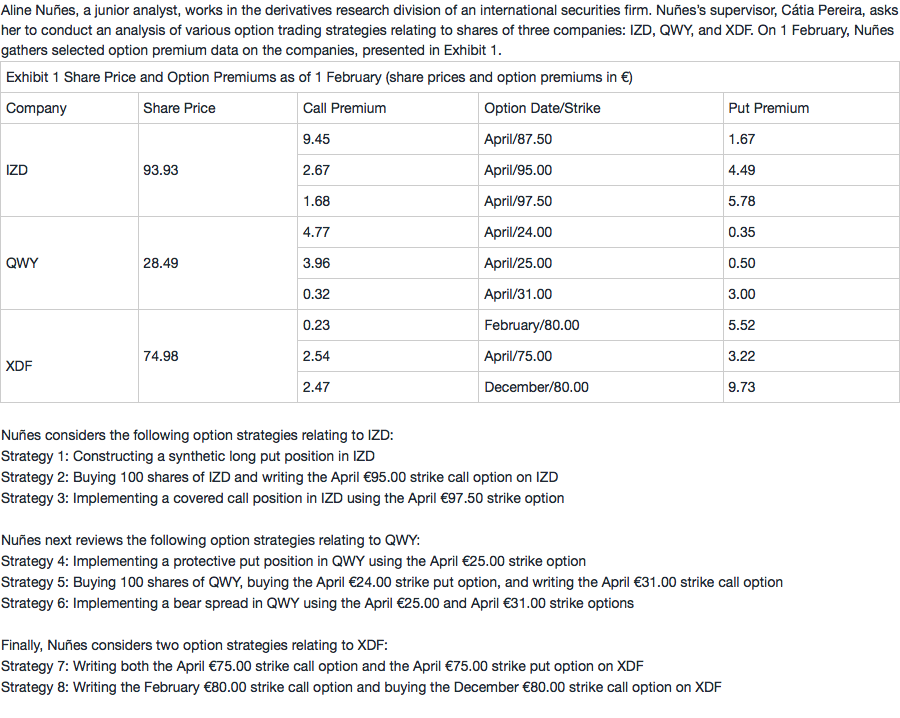

Based on Exhibit 1, the breakeven share price for Strategy 6 is closest to:

选项:

A.€22.50.

€28.50.

€33.50.

解释:

B is correct.

Strategy 6 is a bear spread, which is a combination of a long put option and a short put option on the same underlying, where the long put has a higher strike price than the short put. In the case of Strategy 6, the April €31.00 put option would be purchased and the April €25.00 put option would be sold. The long put premium is €3.00 and the short put premium is €0.50, for a net cost of €2.50. The breakeven share price is €28.50, calculated as XH – (pH – pL) = €31.00 – (€3.00 – €0.50) = €28.50.

怎么可以看出来一定是bear put spread? 为什么不可以是bear call spread? 我试了两个后,才发现了答案,但是这样计算有点慢。谢谢。