问题如下:

Among the carry trades available in the US, Euro, and UK markets, the highest expected return for the USD-denominated portfolio over the next 6 months is closest to:

选项:

A.0.275%.

B.0.85%.

C.0.90%.

解释:

B is correct.

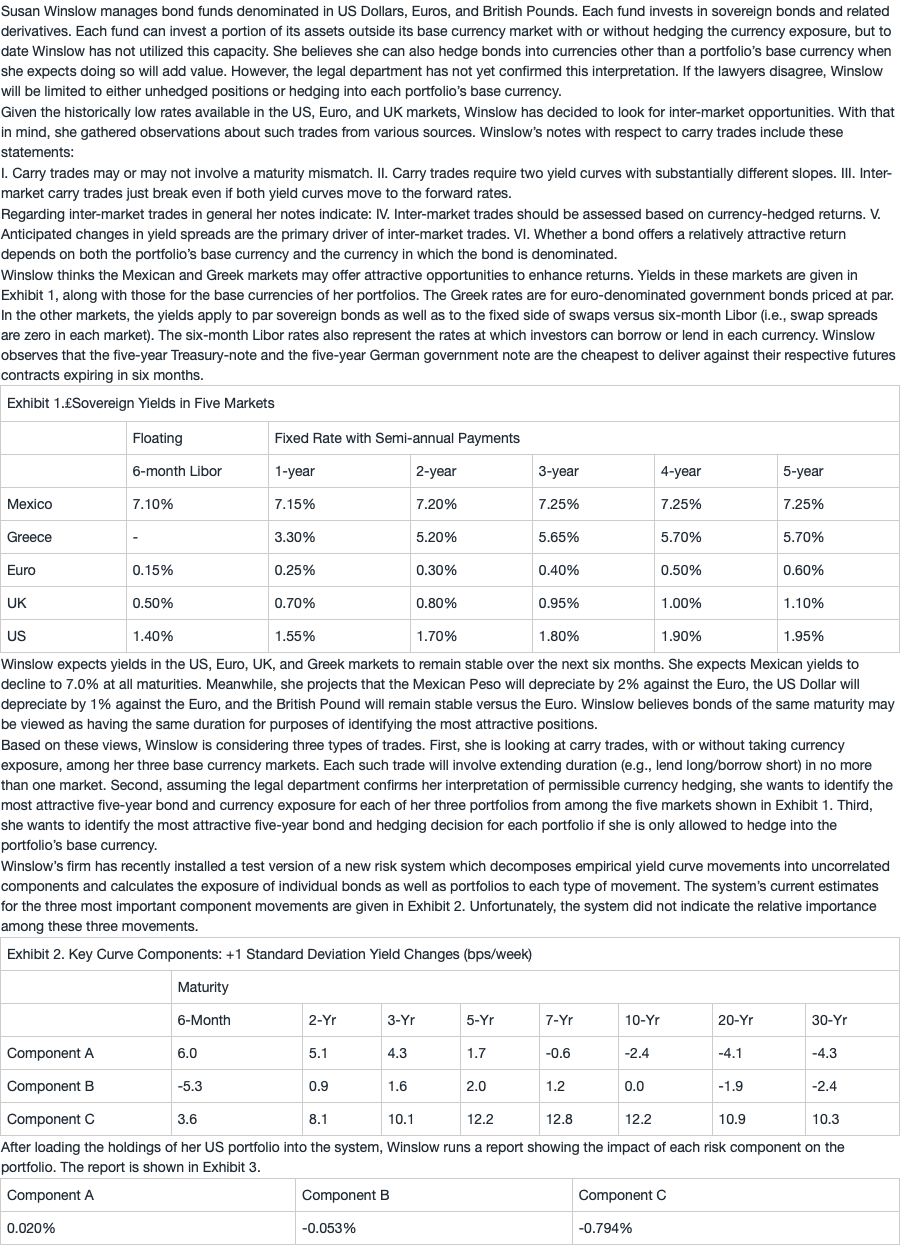

The highest potential return, 0.85%, reflects borrowing USD for 6 months and buying the UK 5-year bond. The carry component of the expected return is actually a loss of 0.15% [= (1.10% – 1.40%)/2], but this is more than offset by the 1% expected appreciation of GBP versus USD. A much higher carry component +0.90% = (1.95% – 0.15%)/2 could be obtained by borrowing for 6 months in EUR to buy the US 5-year note, but that advantage would be more than offset by the expected 1% loss from depreciation of the USD (long) against the Euro (short).

A is incorrect because a higher expected return of 0.85% can be obtained. This answer, +0.275% [= (1.95% – 1.40%)/2], is the highest carry available over the next 6 months within the US market itself (an intra-market carry trade).

C is incorrect. This answer (+0.90%) is the highest potential carry component of return but ignores the impact of currency exposure (being long the depreciating USD and short the appreciating Euro).

为什么计算汇率变动带来收益的时候,用的不是Forward FX 而是 projected spot FX rate 啊?