问题如下:

4. The beta of Tasty Foods stock of 1.10 used by Rae in computing the required return on equity was based on monthly returns for the last 10 years. If Rae uses daily returns for the last 5 years, the beta estimate is 1.25. If a beta of 1.25 is used, what would be Rae’s estimate of the value of the stock of Tasty Foods?

选项:

A.$8.64.

B.$9.10.

C.$20.13.

解释:

B is correct.

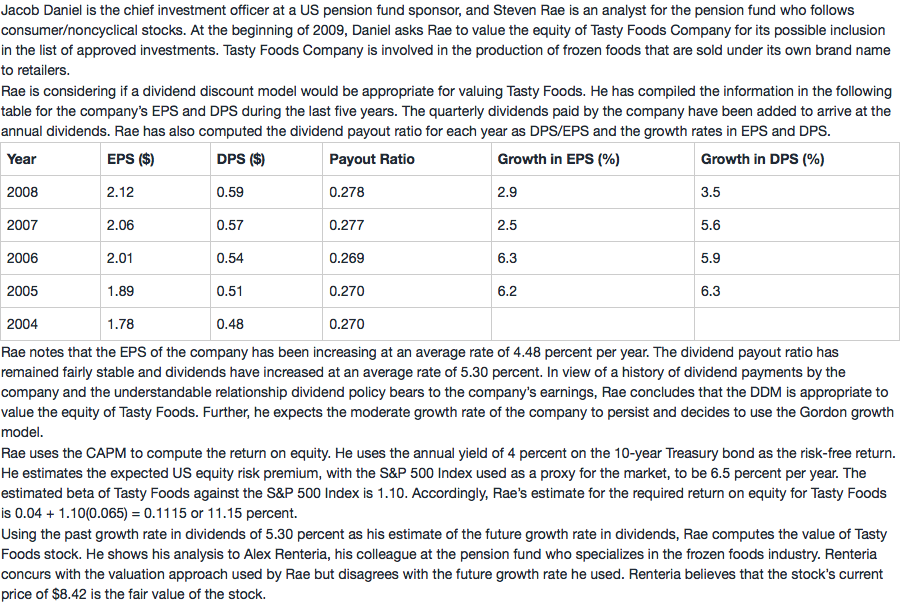

Using a beta of 1.25, Rae’s estimate for the required return on equity for Tasty Foods is 0.04 + 1.25(0.065) = 0.1213 or 12.13 percent. The estimated value of the stock is

$$V_0=\frac{D_1}{r-g}=\frac{0.59(1+0.0530)}{0.1213-0.0530}=\$9.10$$

题目说的Daily return for last 5 yrs, 用不用算EAR呢?是不是我想复杂了还是哪里没有理解对,谢谢!