问题如下:

Six months ago, a dealer sold CHF 1 million forward

against the GBP for a 180-dayterm at an all-in rate of 1.4850 (CHF/GBP). Today,

the dealer wants to roll this positionforward for another six months (i.e., the

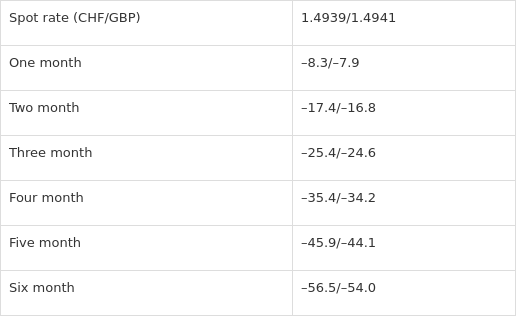

dealer will use an FX swap to roll the positionforward).The following are the

current spot rate and forward points being quoted for theCHF/GBP currency pair:

The cash flow that the dealer will realize on

the settlement date is closest to an:

选项:

A. inflow

of GBP 4,057

inflow

of GBP 8,100

outflow

of GBP 5,422

解释:

180

days ago, the dealer sold 1 million CHF against the GBP for1.4850. Today, the

dealer will have to buy CHF 1 million to settle the maturing forwardcontract,

so the CHF amounts will net to zero on settlement day. Because these CHFamounts

net to zero, the cash flow on settlement day is measured in GBP. The GBPamount

is calculated as follows: 180 days ago, the dealer sold CHF 1 million against

theGBP at a rate of 1.4850, which is equivalent to buying GBP

673,400.67(1,000,000/1.4850). That is, based on the forward contract, the

dealer will receive GBP673,400.67 on settlement day. Today, the dealer is

buying CHF 1 million at a spot rateof 1.4940 (the mid-market spot rate, because

this is an FX swap). This transaction isequivalent to selling GBP 669,344.04

(1,000,000/1.4940). That is, based on the spottransaction, the dealer will pay

out GBP 669,344.04 on settlement day. Combining thesetwo legs of the swap

transaction, we have:

(1,000,000/1.4850)-

(1,000,000/1.4940) = GBP 4,056.63

解析:180天前,该交易商以1英镑兑1.4850瑞郎的价格卖出了100万瑞郎。那么现在,经销商必须购买100万瑞士法郎来结算到期的远期合约,那么结算日的瑞士法郎净额将为零。由于这些瑞士法郎的净值为零,所以结算日的现金流以英镑计算。英镑金额计算如下:180天前,经销商以1.4850的汇率卖出100万瑞郎兑1英镑,相当于买入673,400.67英镑(100万/1.4850)。也就是说,根据远期合同,经销商在结算日收到GBP 673,400.67。今天,该交易商以1.4940瑞郎的即期利率(中间市场即期利率,因为这是一种外汇互换)买入100万瑞郎。这笔交易相当于卖出669,344.04英镑(100亿英镑/1.4940英镑)。也就是说,基于现货交易,该交易商将在结算日支付669,344.04英镑。清算这两部分,可以得到:

(1000000/1.4850)-(1000000/1.4940)=

4056 .63英镑

(1,000,000/1.4850)- (1,000,000/1.4940) = GBP 4,056.63

没看懂 用了1.4850直接计算 ,1.4940也不需要算上6m的points么