NO.PZ2023041003000010

问题如下:

Assume that you own a

dividend-paying stock currently worth $150. You plan to sell the stock in 250

days. In order to hedge against a possible price decline, you wish to take a

short position in a forward contract that expires in 250 days. The risk-free

rate is 5.25 percent. Over the next 250days, the stock will pay dividends

according to the following schedule:

What is the

forward price of a contract established today and expiring in 250 days?

It is now 100 days

since you entered the forward contract. The stock price is $115. What is the

value of the forward contract at this point?

选项:

A.

解释:

A. S0= $150

T = 250/365

r = 0.0525

PV(D,0,T) = $1.25/

F(0,T) = ($150.00

-$3.69)

B.St = $115

F(0,T) = $151.53

t = 100/365

T = 250/365

T -t = 150/365

r = 0.0525

After 100 days, two

dividends remain: the first one in 20 days, and the second one in 110 days.

PV(D,t,T) = $1.25/

Vt

(0,T) = $115.00 -$2.48 -$151.53/(1.0525)150/365 = -$35.86

A negative value

is a gain to the short

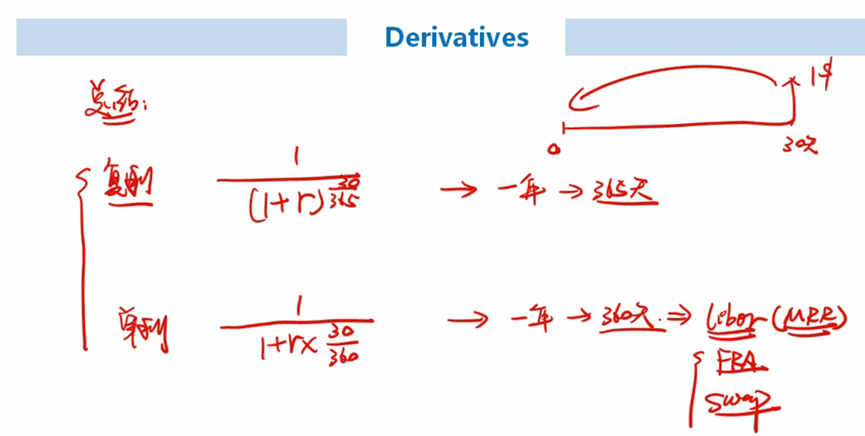

老师好,如题,我看之前几道题算的时候都用360天的。为什么这题就用365呢