NO.PZ2018120301000038

问题如下:

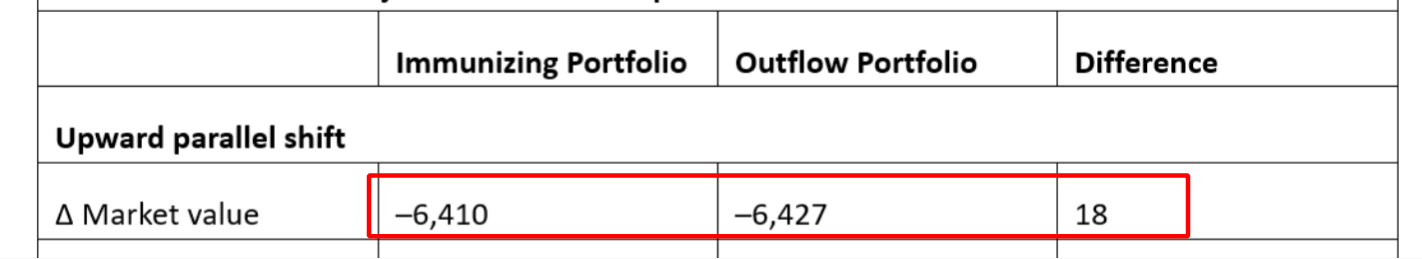

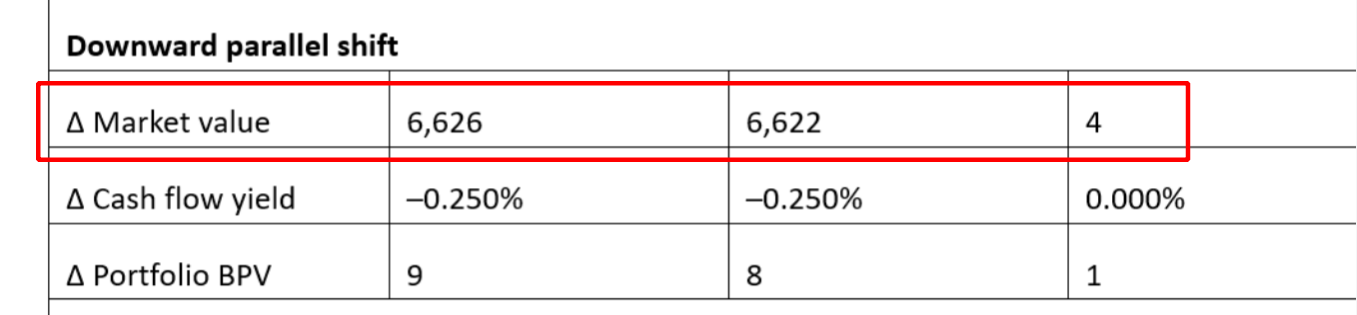

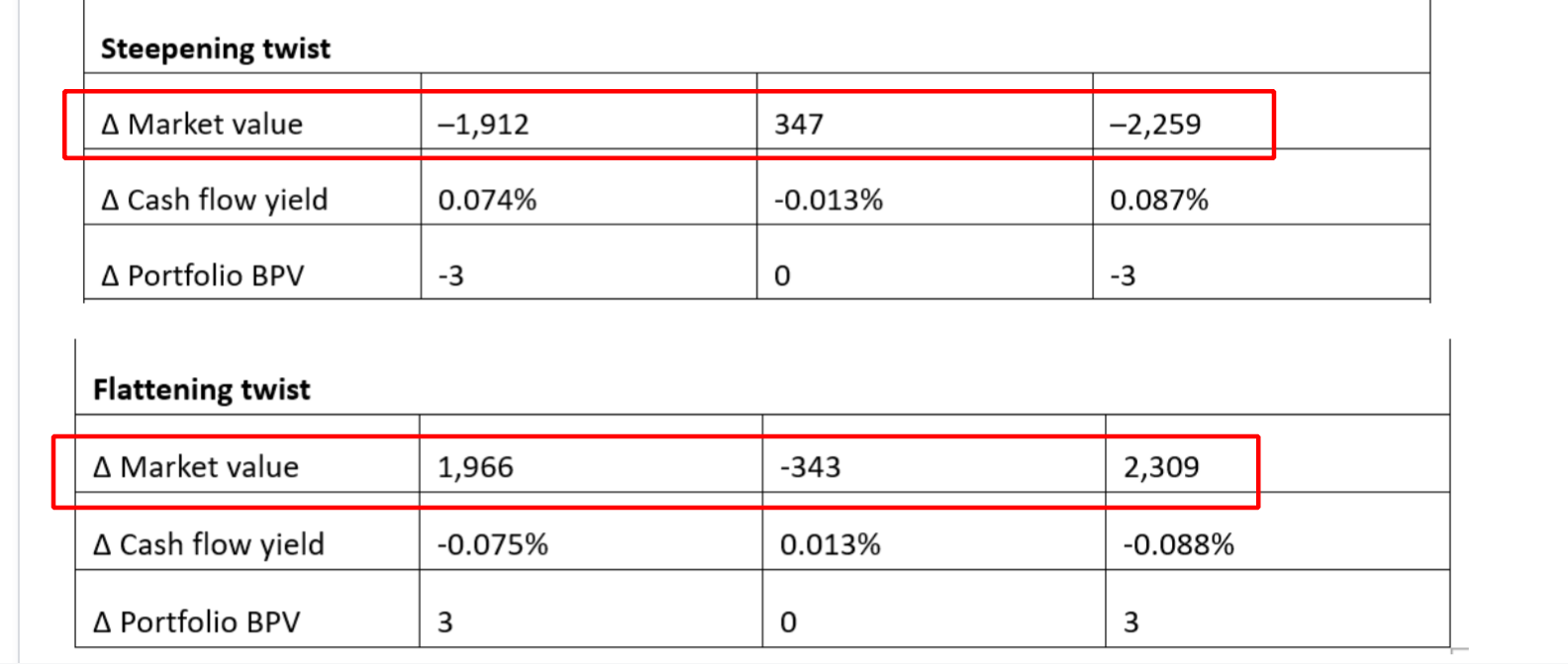

After selecting a portfolio to immunize Schuylkill’s multiple future outflows, Chaopraya prepares a report on how this immunization strategy would respond to various interest rate scenarios. The scenario analysis is presented in Exhibit 3.

Discuss the effectiveness of Chaopraya’s immunization strategy in terms of duration gaps.

选项:

解释:

Correct Answer:

Chaopraya’s

strategy immunizes well for parallel shifts, with little deviation between the

outflow portfolio and the immunizing portfolio in market value and BPV. Because

the money durations are closely matched, the differences between the outflow

portfolio and the immunizing portfolio in market value are small and the

duration gaps (as shown by the difference in Δ Portfolio BPVs) between the

outflow portfolio and the immunizing portfolio are small for both the upward

and downward parallel shifts.

Chaopraya’s

strategy does not immunize well for the non-parallel steepening and flattening

twists (i.e., structural risks) shown in Exhibit 3. In those cases, the

outflow portfolio and the immunizing portfolio market values deviate

substantially and the duration gaps between the outflow portfolio and the

immunizing portfolio are large.

老师好,在flattening的情况下,虽然delta BPV比parallel shift情况中大,但至少MV可以覆盖liability,但在steepening的情况中,MV都无法覆盖liability,免疫是失效的。所以可以把flatten和steepen分开讨论,而不是说non parallel都不是很effective吗?