NO.PZ2018091705000084

问题如下:

Jacques purchases a US$100,000 face value whole life policy has an annual premium of US$2,000, paid at the beginning of the year. Policy dividends of US$500 per year are anticipated, payable at year-end. A cash value of US$32,500 is projected for the end of Year 30. Jacques has a life expectancy of 30 years and a discount rate of 5%. The net payment cost index that Jacques calculate is closest to:

选项: $17.22.

$16.89.

C.$15.24.

解释:

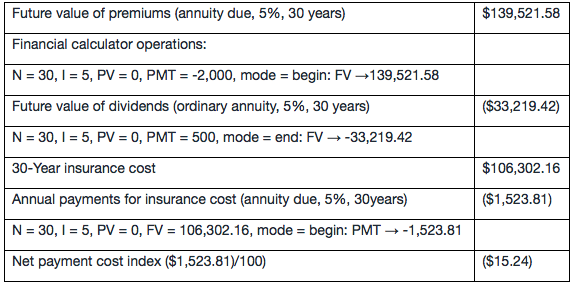

C is correct.

考点: Net payment cost index

解析: The net payment cost index假设被保险人在30年后死亡。计算net payment cost index包括以下步骤:

怎么调begin 现金流?