NO.PZ2024010508000011

问题如下:

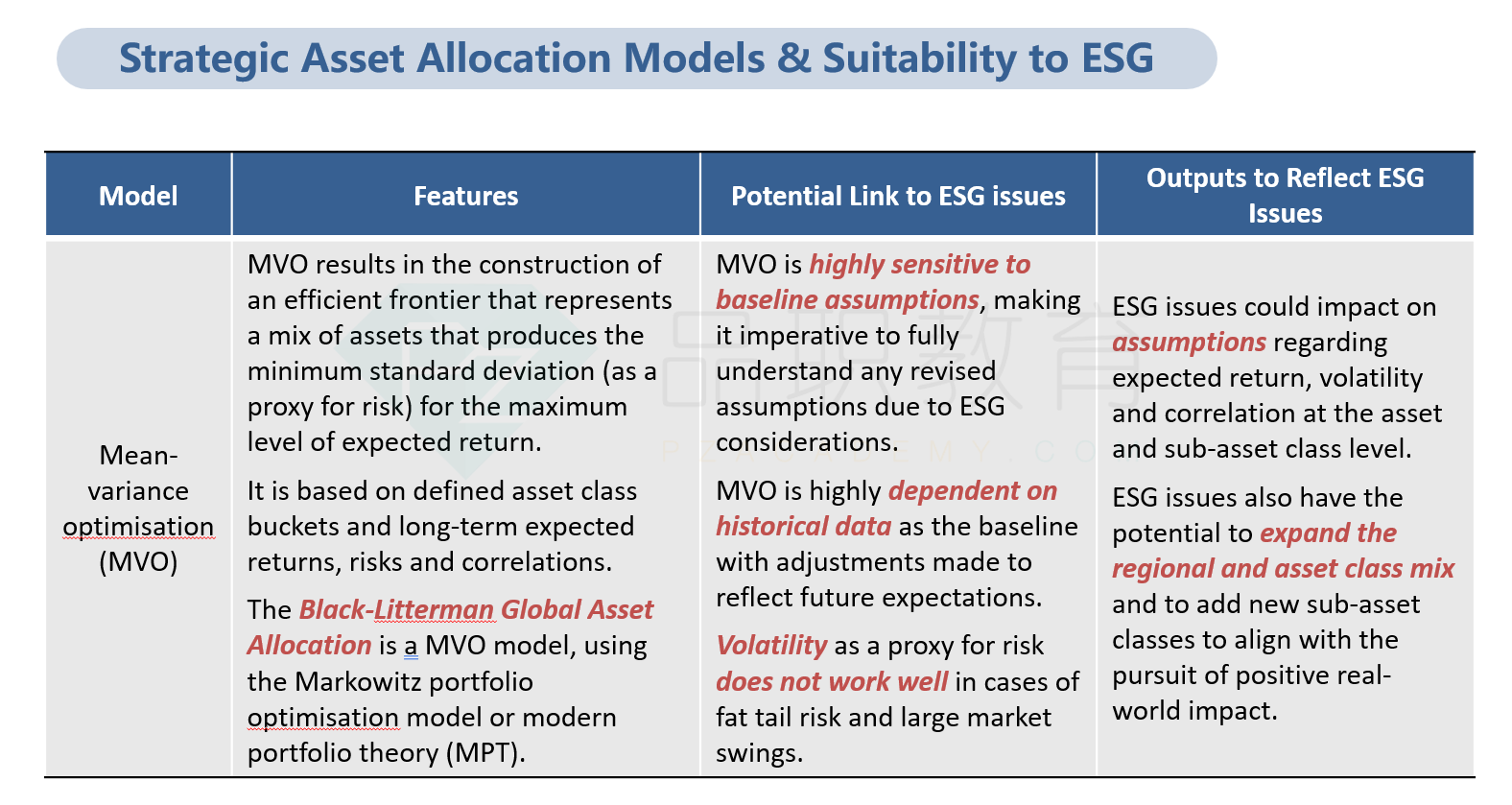

Which of the following is true about the Mean–variance optimization model for strategic asset allocation?选项:

A.It is relevant for considering ESG issues where an abrupt shift is expected over time.

B.It could introduce an additional source of estimation errors due to the need for dynamic rebalancing.

C.It is highly dependent on historical data as the baseline, with adjustments made to reflect future expectations.

解释:

C is correct. Mean–variance optimization is highly sensitive to baseline assumptions, making it imperative to fully understand any revised assumptions due to ESG considerations. The method is also highly dependent on historical data as the baseline, with adjustments made to reflect future expectations.这道题在讲义的什么位置,请老师标注