NO.PZ2023052301000010

问题如下:

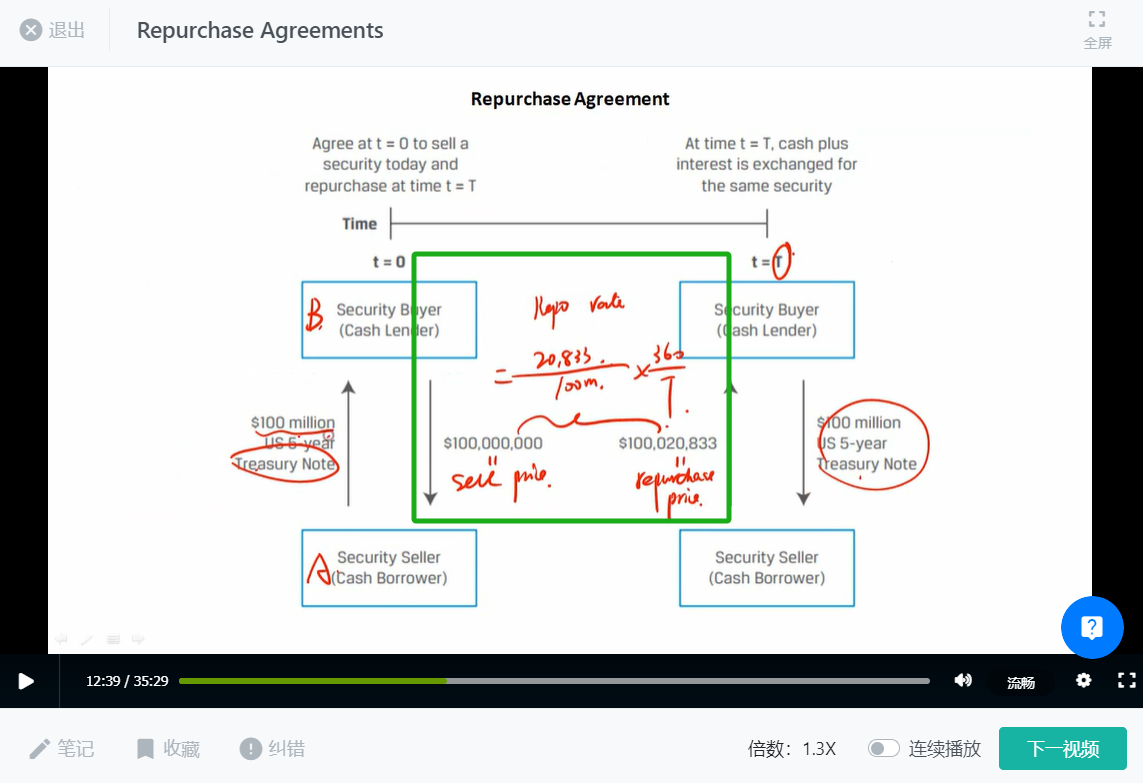

Assume that today (t = 0) the current US five-year Treasury note trades at a price equal to the bond’s face value of USD50,000,000. The security buyer takes delivery of the US Treasury note today and pays the security seller USD50,000,000. Assume a repo term of 45 days (and 360 days in a year) and a repo rate of 0.375%. If the buyer agrees to return the five-year Treasury note 45 days from today (t = T) to the seller, the repurchase price is closest to:

选项:

A.USD50,015,625.

USD50,023,438.

USD50,187,500.

解释:

B is correct. USD50,023,438 is calculated as:

USD50,000,000 × [1 + (0.375% × 45/360)] = USD50,023,438.

In effect, the security seller borrows USD50,000,000 on a short-term basis at a low cost, with interest (USD23,438) paid at maturity, because the loan is collateralized by the US Treasury note.

A is incorrect because a repo term of 30 days, as opposed to 45 days, is incorrectly used:

USD50,000,000 × [1 + (0.375% × 30/360)] = USD50,015,625.

C is incorrect because the repo term and number of days in a year are not used:

USD50,000,000 × (1 + 0.375%) = USD50,187,500.

没看懂