NO.PZ2023091802000160

问题如下:

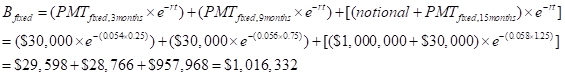

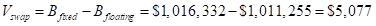

Consider a $1 million notional swap that pays a floating rate based on 6-month LIBOR and receives a 6% fixed rate semiannually. The swap has a remaining life of 15 months with pay dates at 3, 9 and 15 months. Spot LIBOR rates are as following: 3 months at 5.4%; 9 months at 5.6%; and 15 months at 5.8%. The LIBOR at the last payment date was 5.0%. Calculate the value of the swap to the fixed-rate receiver using the bond methodology.

选项:

A.$6,077

B.-$6,077

C.-$5,077

D.$5,077

解释: