NO.PZ2023040402000022

问题如下:

Jose Rivera estimates the forward-looking equity risk premium using the Gordon growth model (GGM). Rivera adds 1.50% to the risk premium he has computed to account for the additional small firm risk premium associated with BTP.

Using Exhibit 1 and Rivera's adjustment, the risk premium for BTP stock according to the Gordon growth model is closest to:

选项:

A.5.77%.

5.61%.

7.02%.

解释:

First compute the GGM equity risk premium and then add Rivera’s adjustment for small firm risk premium. Computations are as follows:

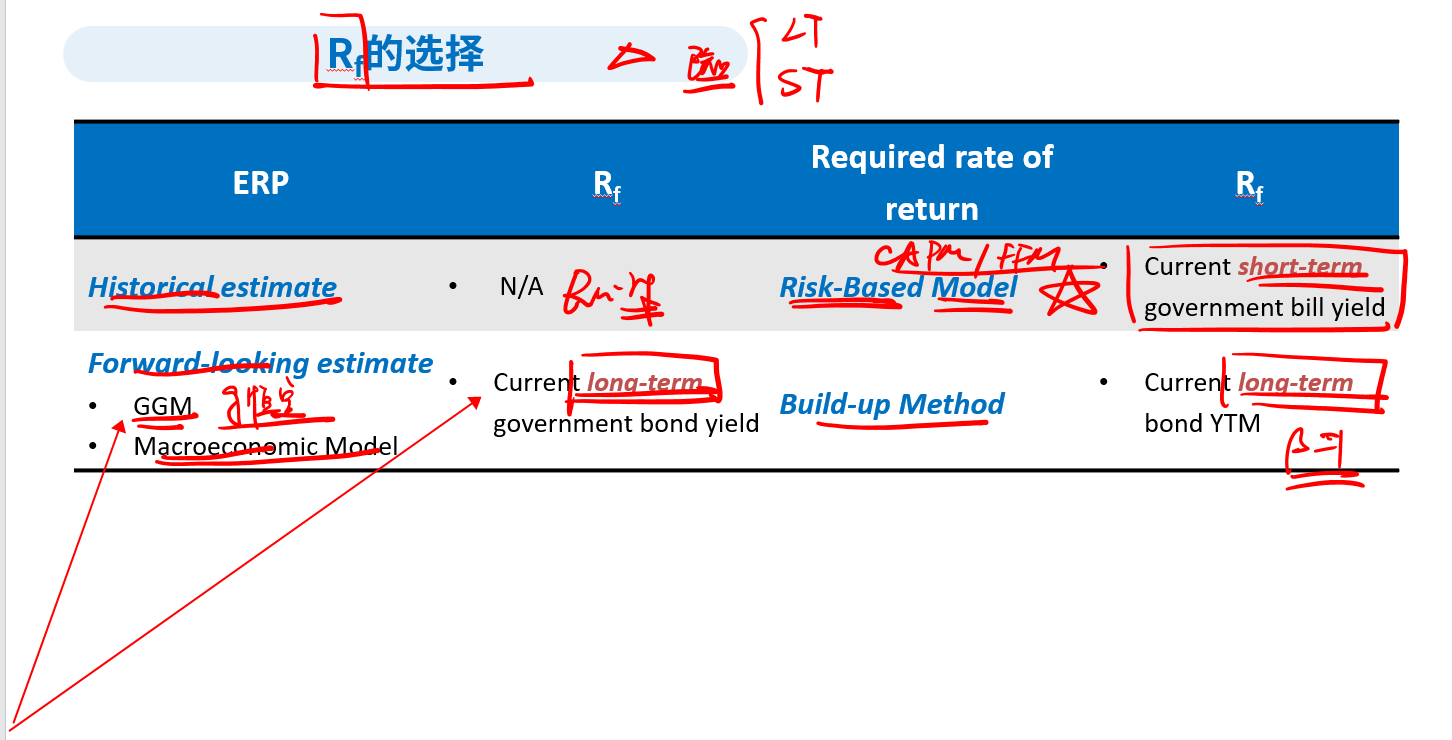

GGM equity risk premium estimate = Dividend yield on the index based on year-ahead aggregate forecasted dividends and aggregate market value + Consensus long-term earnings growth rate ̶ Current long-term government bond yield

因为用的是GGM?