NO.PZ2023071902000121

问题如下:

Question In the face of an unexpected and highly impactful risk event(black swan risk), what adjustment are investors most apt to make?

选项:

A.Tactical B.Sector specific C.Asset allocation解释:

Solution

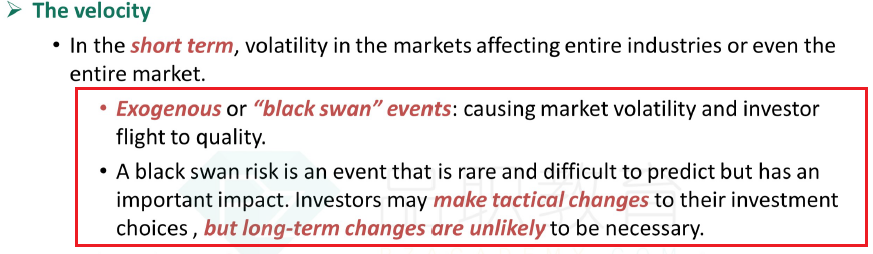

- Correct because the rate at which geopolitical risk influences an investment portfolio is described as its velocity. Distinguishing between short-term 'high velocity', medium-term, and long-term 'low velocity' effects, we can see that in the immediate aftermath, there might be market disturbances affecting entire sectors or the market as a whole. Black swan events, being unanticipated and significant, tend to fall into this bracket, inducing market instability and a rush by investors towards safer assets. Given the unpredictable nature of black swan events, investors with suitable risk tolerance and investment horizons might opt for tactical adjustments to their investment decisions. Fundamental, long-term alterations are generally not mandated.

- Incorrect as this pertains to the medium-term impact of geopolitical risks: Such risks, unfolding over a medium duration, can hinder corporate operations, inflate costs, and restrict investment prospects, thereby diminishing valuations. These types of risks are generally sector-specific, disproportionately affecting certain companies over others.

- Incorrect as it leans towards the low velocity fallout of geopolitical risks: The speed with which geopolitical risk affects investment decisions is a critical aspect. The distinction between short-term 'high velocity', medium-term, and long-term 'low velocity' effects becomes vital. Long-standing risks can lead to significant environmental, societal, and governance repercussions. Consequently, they might necessitate re-evaluation and adjustments in an investor's overall asset allocation strategies, encompassing asset class selection and investment approaches, particularly over extended horizons. However, their immediate repercussions on portfolios are generally subdued.

•

A正确,因为地缘政治风险影响投资组合的速率被描述为其速度。在区分短期“高速”、中期和长期“低速”效应过程中,我们意识到,在直接后果发生后,可能会出现影响整个行业或整个市场的市场动荡。黑天鹅事件往往属于这一类,因为它们出乎意料且意义重大,会导致市场不稳定,并促使投资者争相购买更安全的资产。鉴于黑天鹅事件的不可预测性,具有适当风险承受能力和投资视野的投资者可能会选择对其投资决策进行战术调整。而基本的、长期的改变通常不是强制性的。

B不正确,因为这与地缘政治风险的中期影响有关:这种风险,在中等时间内展开,可能会阻碍公司运营,增加成本,限制投资前景,从而降低估值。这些类型的风险通常是针对特定行业的,对某些公司的影响比对其他公司的影响更大。

C不正确,因为它倾向于地缘政治风险的低速影响:地缘政治风险影响投资决策的速度是一个关键方面。区分短期“高速”、中期和长期“低速”效应变得至关重要。长期存在的风险可能导致严重的环境、社会和治理影响。因此,它们可能需要重新评估和调整投资者的总体资产分配战略,包括资产类别选择和投资方法,特别是在较长的期限内。然而,它们对投资组合的直接影响通常是温和的。

我记得老师上课讲过但忘记了