NO.PZ201803130100000108

问题如下:

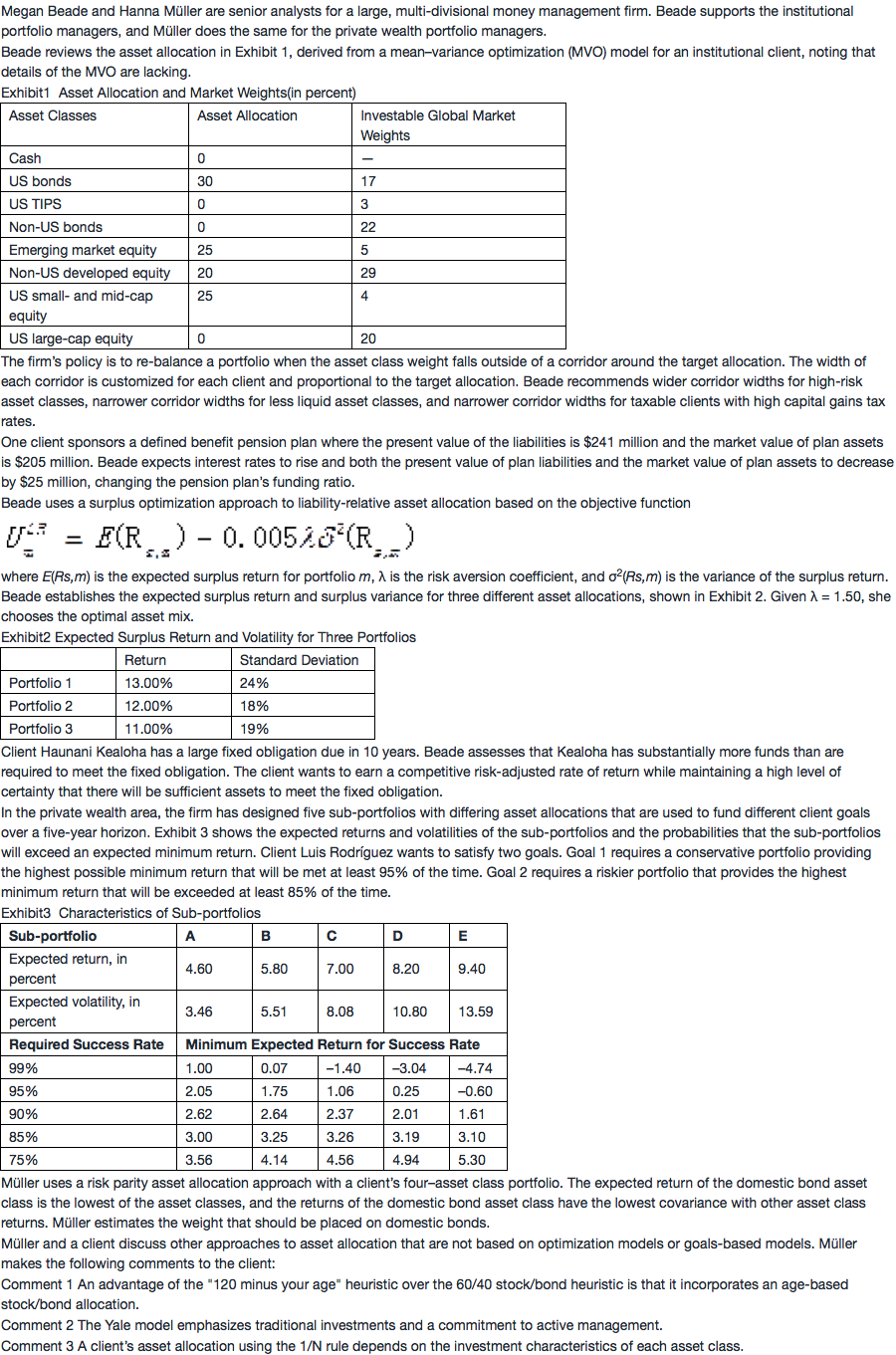

Which of Müller’s comments about the other approaches to asset allocation is correct?

选项:

A.Comment 1

B.Comment 2

C.Comment 3

解释:

A is correct.

Comment 1 is correct because the "120 minus your age" rule reduces the equity allocation as the client ages, while the 60/40 rule makes no such adjustment. Comments 2 and 3 are not correct. The Yale model emphasizes investing in alternative assets (such as hedge funds, private equity, and real estate) as opposed to investing in traditional asset classes (such as stock and bonds). The 1/N rule allocates an equal weight to each asset without regard to its investment characteristics, treating all assets as indistinguishable in terms of mean returns, volatility, and correlations.

3为什么错了