NO.PZ2023091701000047

问题如下:

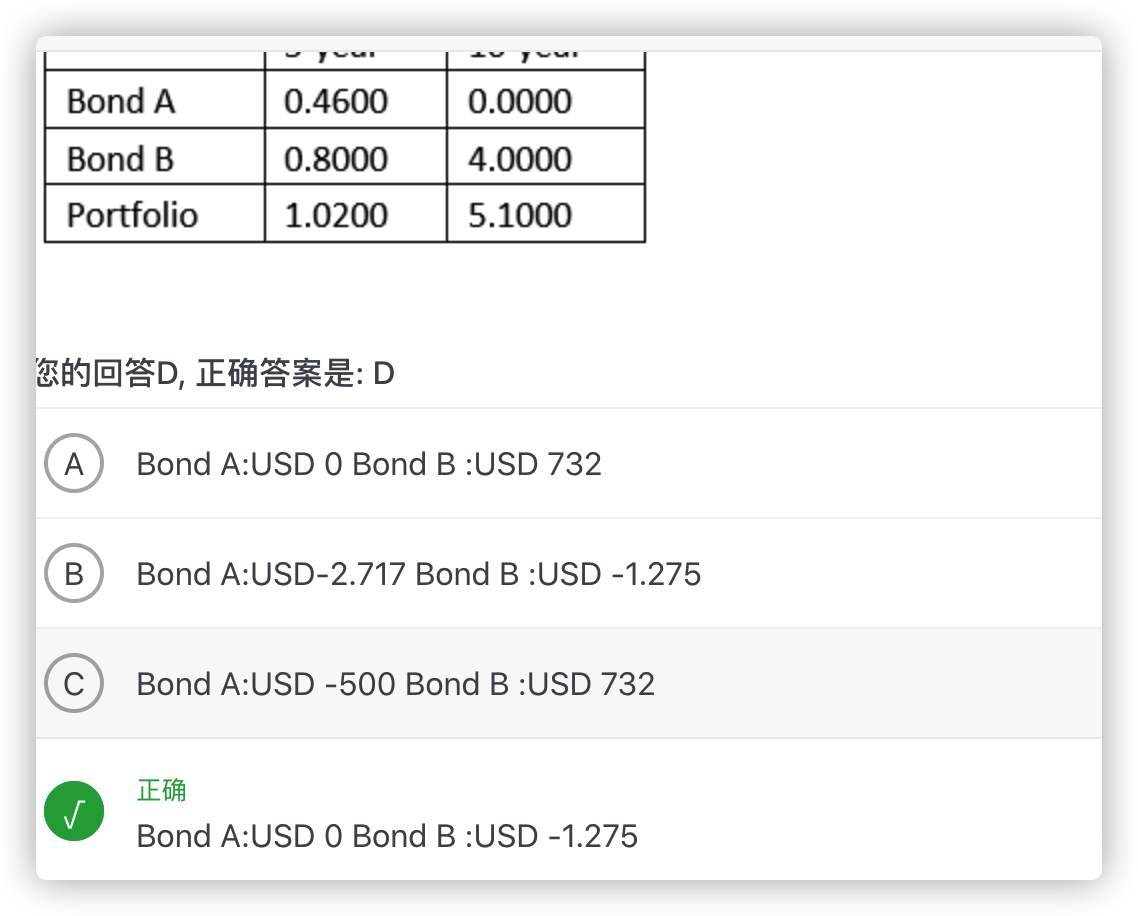

A risk manager wants to protect a portfolio of non-callable bonds against interest rate risk and is considering taking positions in two additional bonds, Bond A and Bond B, to accomplish this. Given the following information, what positions in Bond A and Bond B immunize the portfolio against change in the 5-year and 10 –year key rates?

选项:

A.Bond A:USD 0 Bond B :USD 732 B.Bond A:USD-2.717 Bond B :USD -1.275 C.Bond A:USD -500 Bond B :USD 732 D.Bond A:USD 0 Bond B :USD -1.275解释: