NO.PZ2023040501000082

问题如下:

Trana, which reports under International Financial Reporting Standards (IFRS), is a Sweden-based retailer operating stores. In 2012, at the start of Trana’s expansion into North American markets, the company established a subsidiary, Anart Inc., in a South American country to benefit from lower labor and shipping costs. The details of the Anart investment are as follows:

Anart is 80% owned by Trana with 20% local investment.

It sells all of its production to Trana and Trana’s other subsidiaries and determines the transfer price as full cost plus 5%.

Throughout 2013, the South American country experienced high rates of inflation, approaching 30% per year. Trana had originally assumed that the high inflation rate was temporary, but it has shown no signs of decreasing and is now a concern. Eriksson and Lars discuss the impact of Anart on Trana’s financial statements and Eriksson asks Lars:

“Is the same accounting method being used this year to account for Anart in the consolidated financial statements as in prior years?”

Which of the following is Lars’s most appropriate answer to Eriksson’s question concerning the accounting method used for Anart in 2015?

选项:

A.

No, the current rate method is being used, after restating nonmonetary items for inflation.

B.

No, the current rate method is being used, after restating all accounts for the general price index.

C.

Yes, the temporal method is being used, as in past years.

解释:

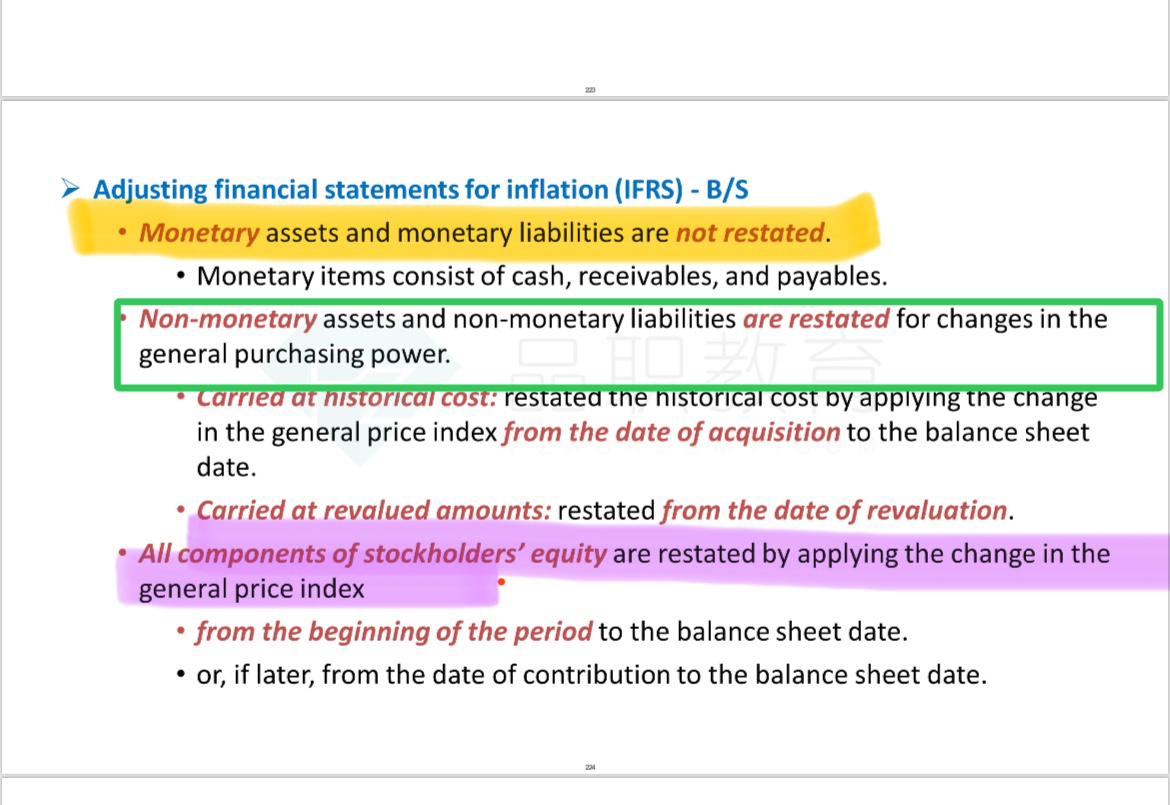

Because Anart is an extension of Trana (Anart sells 100% of its production to the group) its functional currency would be the Swedish krona, not the local currency, and it would be considered an integrated foreign operation. As an integrated foreign operation, Trana would normally, and historically, have accounted for Anart using the temporal method. But the country in which Anart operates is experiencing high inflation; three years (2013–2015) of rates near 30% would exceed the 100% indicator of hyperinflation. Therefore, under IFRS, the nonmonetary items must be adjusted for the loss in purchasing power to better reflect economic reality. Note that only the nonmonetary items are adjusted because monetary ones would already be expressed in the monetary unit current at the balance sheet date.

是不是计算net purchasing power gain or loss 时 monetary and non monetary都要考虑?而 restate 只针对 non monetary 。但是 equity 里的 capital 老师说也 restate呀 capital 属于 non monetary吗