NO.PZ2018103102000105

问题如下:

Matt is evaluating Company M by using the multistage residual income model. He has forecasted that residual income per share will be constant from year 3 into perpetuity and the short-term ROE is higher than the long-term ROE. He has also estimated the earnings and dividends for the following three years in the following table. What`s the intrinsic value of Company M?

选项:

A.$27.18

B.$48.91

C.$55.43

解释:

C is correct.

考点:Multistage Residual Income Valuation

解析:先计算出每一年的BV

BV1 = BV0 + EPS - Dividends per share = 28.25 + 6.5 - 1.75 = $33,同理可得BV2 = $38.19,BV3 = $43.15

再计算出每一年的RI

RI1 = EPS1 – re*B0 = 6.50-10.9%*28.25 = $3.42,同理可得RI2 = $4.22,RI3 = $2.77

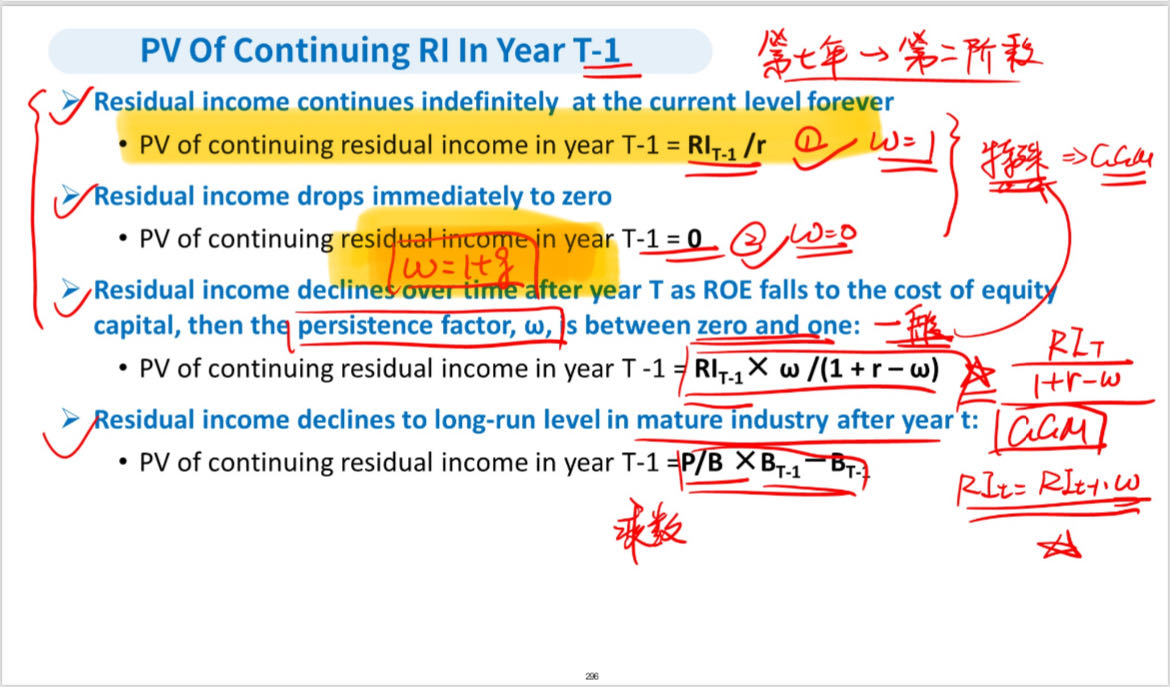

终值的现值:

老师按照李老师公式,PVRI3不应该是2.77)*W/(1+10.9%-W),其中W=1-g=94.5%,然后再用10.9%来折现吗,算出来的终值等于15.96,PVRI3则等于11.7。