NO.PZ202401170100001006

问题如下:

The specialist hedge fund strategy that Mukilteo plans to recommend is most likely选项:

A.cross-asset volatility trading between the US and Japanese markets. B.selling equity volatility and collecting the volatility risk premium. C.buying longer-dated out-of-the-money options on VIX index futures解释:

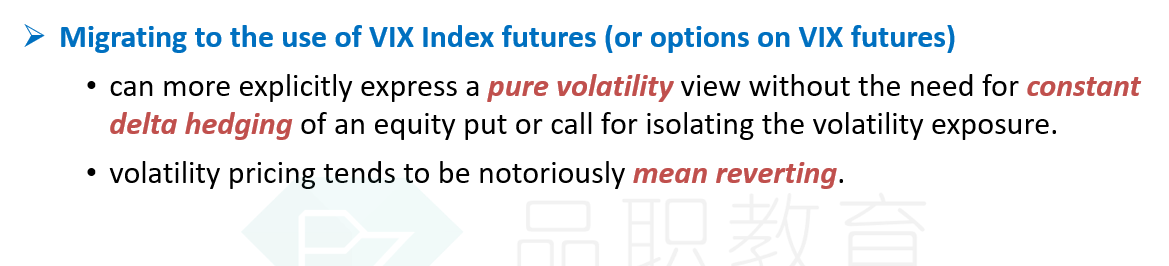

C is correct. Mukilteo needs to recommend a specialist hedge fund strategy that

can help PWPF maintain a high Sharpe ratio even in a crisis when equity markets fall. Buying longer-dated out-of-the-money options on VIX index futures

is a long equity volatility position that works as a protective hedge, particularly

in an equity market crisis when volatility spikes and equity prices fall. A long

volatility strategy is a useful potential diversifier for long equity investments

(albeit at the cost of the option premium paid by the volatility buyer). Because

equity volatility is approximately 80% negatively correlated with equity market

returns, a long position in equity volatility can substantially reduce the portfolio’s

standard deviation, which would serve to increase its Sharpe ratio. Longer-dated

options will have more absolute exposure to volatility levels (i.e., vega exposure)

than shorter-dated options, and out-of-the-money options will typically trade at

higher implied volatility levels than at-the-money options.

请问这个题目是啥意思?为啥选C。为啥不选b,哪里的考点