NO.PZ202209270100000201

问题如下:

Which profitability metric should French use to assess Archway’s five-year historic performance relative to its competitors?

选项:

A.Current ratio B.Operating margin C.Return on invested capital解释:

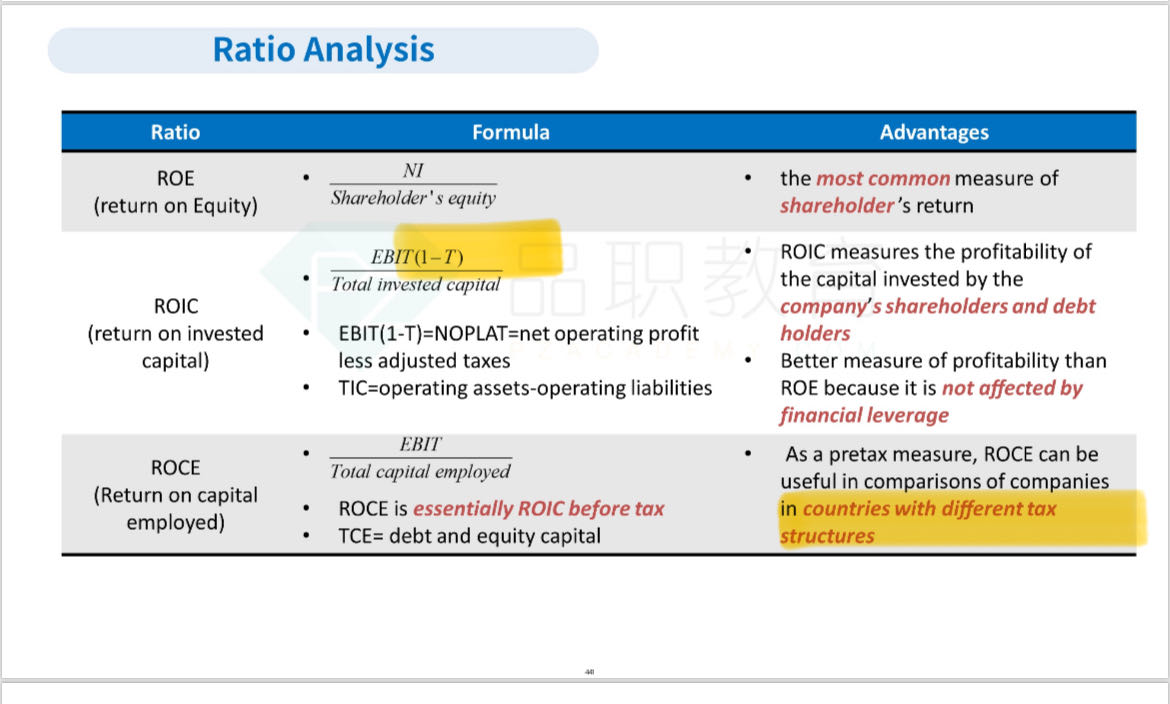

B is correct. Operating (EBIT) margin is a pre-tax profitability measure that can be useful in the peer comparison of companies in countries with different tax structures. Archway’s two main competitors are located in different countries with significantly different tax structures; therefore, a pre-tax measure is better than an after-tax measure, such as ROIC. The current ratio is a liquidity measure, not a profitability measure.

不应该是roice怎么是operating margin