NO.PZ202208300100000702

问题如下:

From 2017 to 2018, the risk related to the investment allocation for NANLife is best described as having shown:选项:

A.no change. B.a decrease. C.an increase.解释:

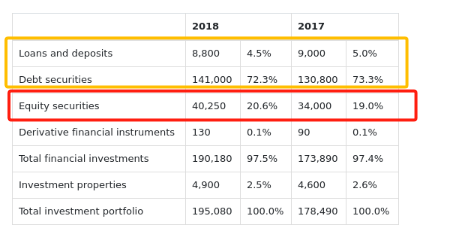

SolutionC is correct. When the investment portfolio is examined using a common-size format, the proportion of the portfolio invested in equity securities has increased from 19.0% to 20.6% (see table below) whereas the proportion allocated to loans and deposits and debt securities has decreased. Equity investments are normally riskier than fixed-income investments, which would indicate that the investment portfolio’s asset allocation is riskier in 2018 than in 2017.

Analysis of NANLife’s Investment Portfolio Asset Allocation

A is incorrect. The total financial investments have not changed materially (97.4% to 97.5%), but that is not the best measure of the risk of the investment portfolio. The allocation of the portfolio between fixed-income and equity securities is a better measure of portfolio risk.

B is incorrect. The proportion allocated to loans and deposits and debt securities has decreased, but this would decrease the overall risk of the investment portfolio because fixed-income investments are less risky than equity investments. The higher proportion allocated to equity would increase the portfolio risk.

这题是看啥上升的?没太理解