NO.PZ2022120701000018

问题如下:

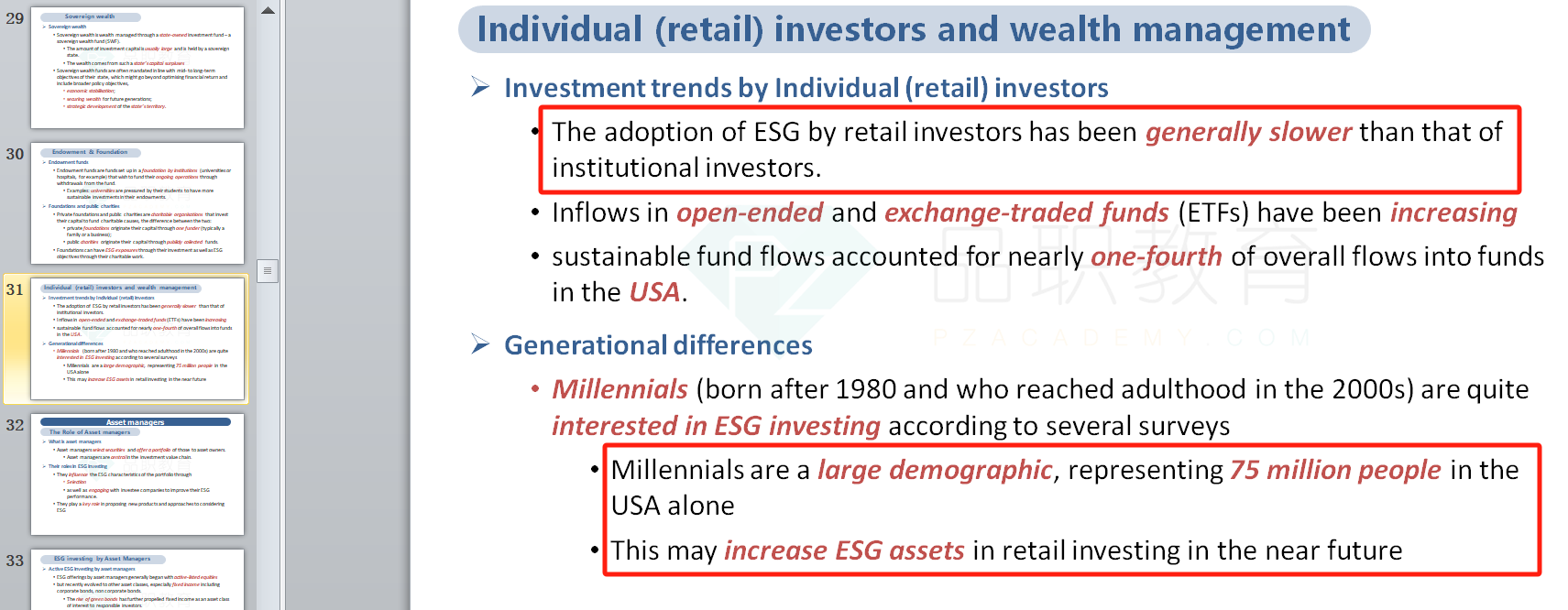

Which of the following is most accurate with respect to individual investors?选项:

A.Retail investors are often referred to as “universal owners.” B.Retail investors have been faster in adopting ESG investing compared to institutional investors. C.Millennial high-net-worth investors are more likely to review the impact of their investment holdings than Generation X high-net-worth investors.解释:

Studies and surveys have generally found that younger high-net-worth investors are most likely to review the ESG impact of their investment holdings, including 88% of millennials and 70% of Generation X老师,这道题的A和B为什么错了