NO.PZ2016031001000070

问题如下:

Bond G, described in the exhibit below, is sold for settlement on 16 June 2014.

Annual Coupon 5%

Coupon Payment Frequency Semiannual

Interest Payment Dates 10 April and 10 October

Maturity Date 10 October 2016

Day Count Convention 30/360

Annual Yield-to-Maturity 4%

The accrued interest per 100 of par value for Bond G on the settlement date of 16 June 2014 is closest to:

选项:

A.

0.46.

B.

0.73.

C.

0.92.

解释:

C is correct.

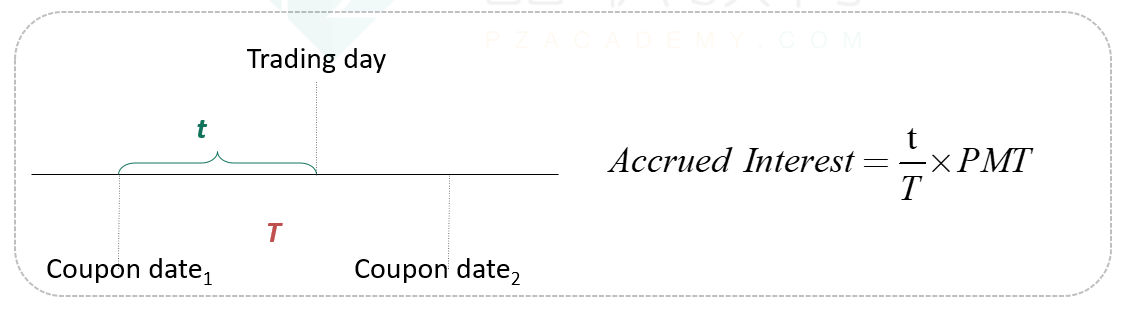

The accrued interest per 100 of par value is closest to 0.92. The accrued interest is determined in the following manner: The accrued interest period is identified as66/180. The number of days between 10 April 2014 and 16 June 2014 is 66 days based on the 30/360 day count convention. (This is 20 days remaining in April + 30 days in May +16 days in June = 66 days total). The number of days between coupon periods is assumed to be 180 days using the 30/360 day convention.

where:

t = number of days from the last coupon payment to the settlement date

T = number of days in the coupon period

t/T= fraction of the coupon period that has gone by since the last payment

PMT = coupon payment per period

考点:accrued interest

解析:accrued interest=coupon×t/T=(5/2)×(66/180)=0.92,故选项C正确。

由于债券半年付息,所以一期的coupon是2.5。t=66,代表的是trading day和上一个付息日之间的天数,4月10号到6月16号之间是66天。T代表的就是两个付息日之间的天数,由于我们现在是30/360,所以半年天数就是180天。将上述数据代入accrued interest的公式即可。

为什么是减去上一个付息日的天数不是减去下一个付息日天数