NO.PZ2018062007000041

问题如下:

Which of following statements is most likely correct? Assume two options on the same underlying.

选项:

A.

For two European call options with the same exercise price, the one with a longer time to maturity has lower value.

B.

For two European call options with the same exercise price, the one with a longer time to maturity has higher value.

C.

For two European call options with the same time to maturity, the one with a higher exercise price has higher value.

解释:

B is correct.

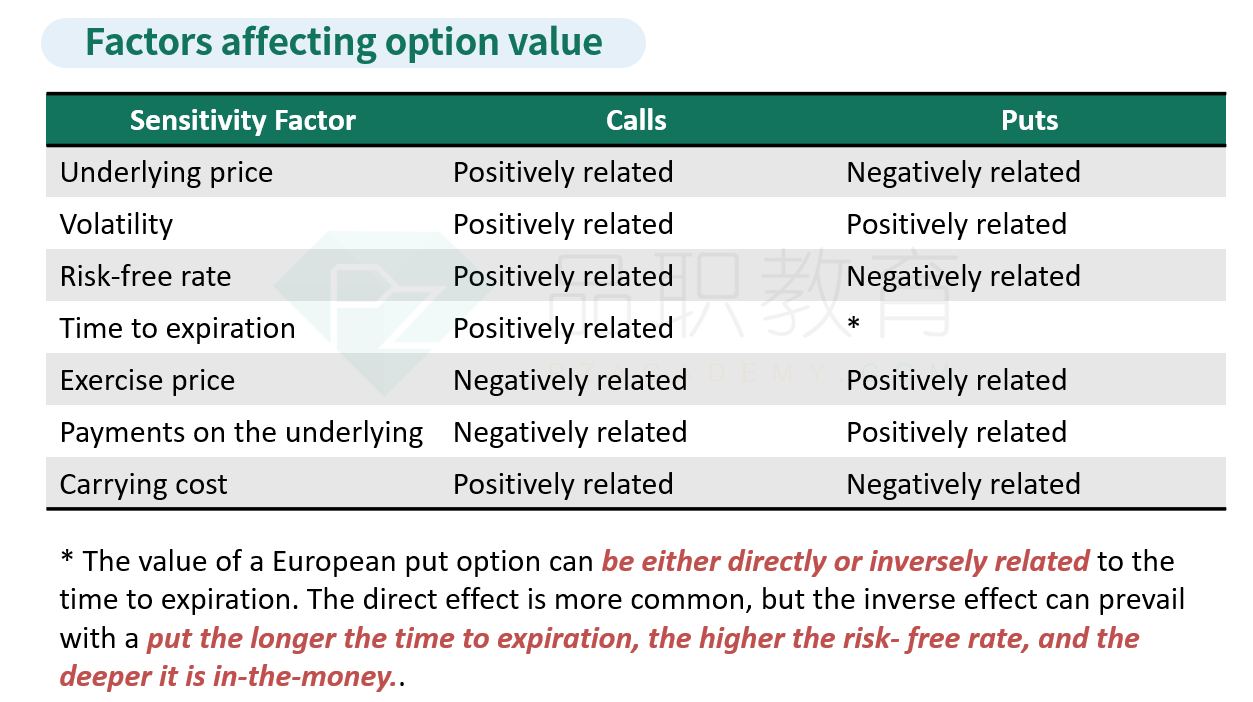

The value of European call option is positively correlated with time to maturity and negatively correlated with exercise price.

中文解析:

欧式看涨期权的价值与到期时间正相关,因此B对,A错

欧式看涨期权的价值与执行价格负相关,C错。

欧式期权随行权期延长可能价值上升或者下降,为什么能确定一定越长越贵