NO.PZ202105270100000201

问题如下:

Calculate the implied contribution to Cambo’s US equity return forecast from the expected change in the P/E.

选项:

解释:

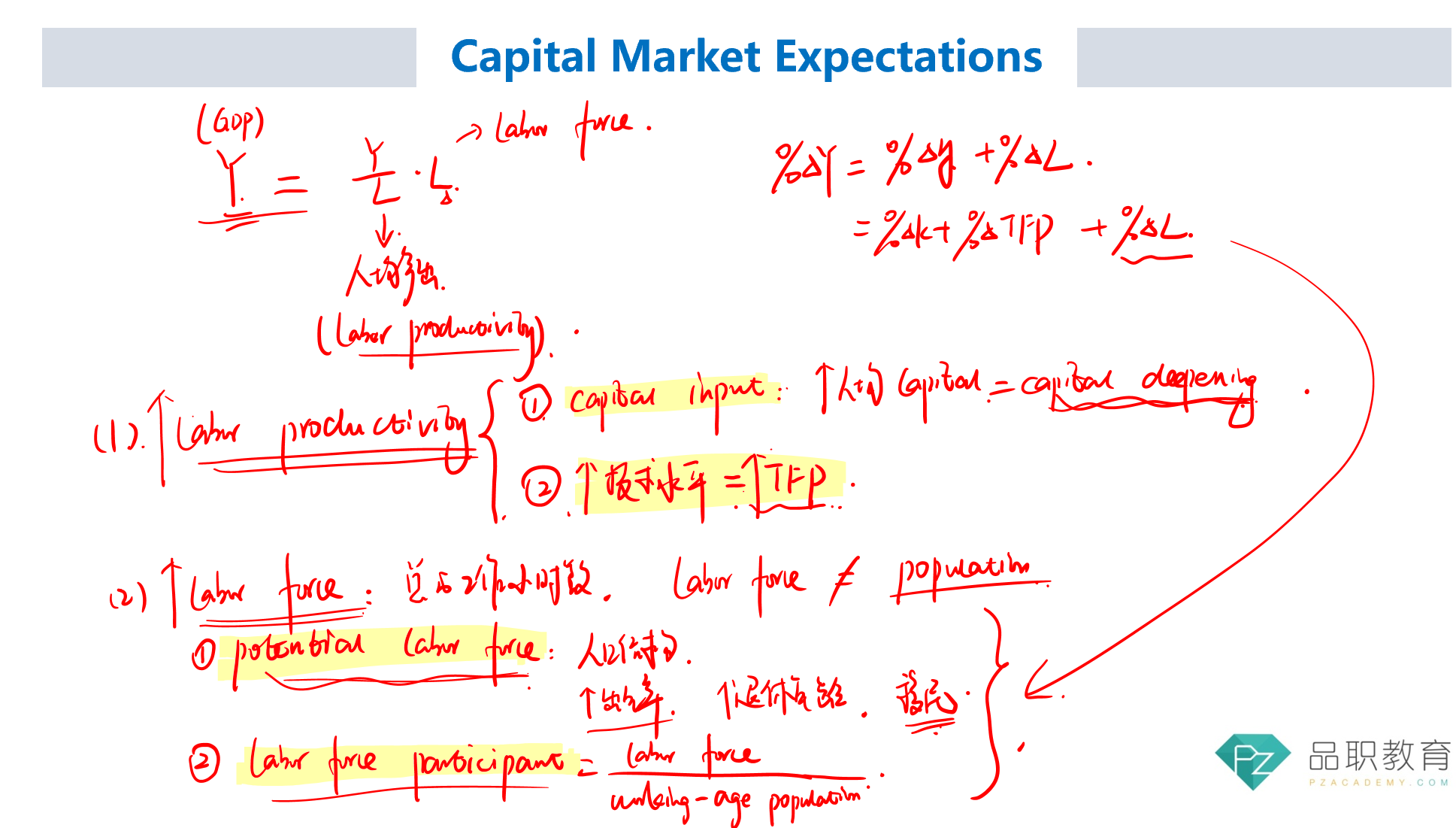

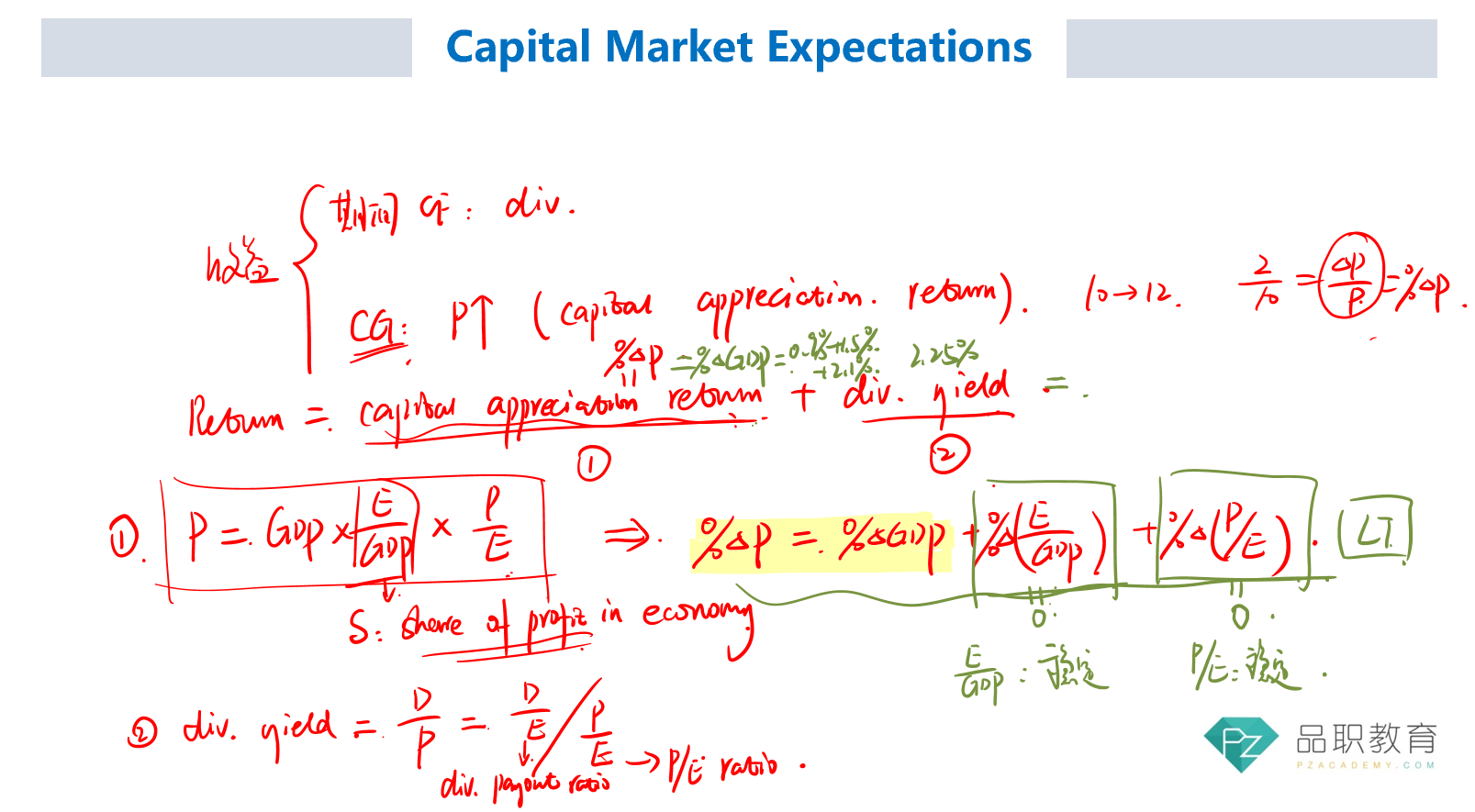

The growth rate in the aggregate market value of equity is expressed as a sum of the following four factors: (1) growth rate of nominal GDP, (2) the change in the share of profits in GDP, (3) the change in P/E, and (4) the dividend yield. The growth rate of nominal GDP is the sum of the growth of real GDP and inflation.

The growth rate of real GDP is estimated as the sum of the growth rate in the labor input and the growth rate in labor productivity. Based on the chief economist’s estimates, the macroeconomic forecast indicates that nominal GDP will increase by 4.0% (= 0.5% labor input + 1.3% productivity + 2.2% inflation).

Assuming a 2.8% dividend yield and no change in the share of profits in the economy, Cambo’s forecast of a 9.0% annual increase in equity returns implies a 2.2% long-term contribution (i.e., 9.0% equity return − 4.0% nominal GDP − 2.8% dividend yield) from an expansion in the P/E.

权益总市值的增长率表示为以下四个因素的总和:(1)名义GDP增长率,(2)利润占GDP份额的变化,(3)市盈率的变化,(4)股息收益率。名义GDP增长率是实际GDP增长率和通货膨胀率之和。

实际GDP增长率估计为劳动投入增长率与劳动生产率增长率之和。根据首席经济学家的预测,宏观经济预测显示,名义GDP将增长4.0%(= 0.5%的劳动投入+ 1.3%的生产率+ 2.2%的通货膨胀)。

假设股息收益率为2.8%,且利润在经济中所占的份额不变,Cambo预测股权回报年增长率为9.0%,这意味着市盈率的为2.2%(即9.0%股权回报- 4.0%名义GDP - 2.8%股息收益率)

就是我去翻了讲义,没有看到div yield部分,这里好像没有讲过?