NO.PZ2023090401000055

问题如下:

Question A group of credit risk analysts at a large bank is discussing regulatory capital and

economic capital in relation to different types of risk exposures. The analysts

evaluate differences in the approach to calculating these measures and in their use.

In comparing the two types of capital, which of the following statements would the

analysts be correct to make?

选项:

A.

Firm-wide economic capital is typically equal to the sum of the separately calculated capital amounts for credit risk, market risk, and operational risk.

B.

An increase in the probability of default of a loan portfolio increases economic capital, while leaving regulatory capital unchanged.

C.

Economic capital is the amount of capital a bank needs to cover its expected losses, while regulatory capital is the amount of capital a bank needs to cover its unexpected losses.

D.

Firm-wide economic capital typically considers correlations between credit risk, market risk, and operational risk.

解释:

Explanation:

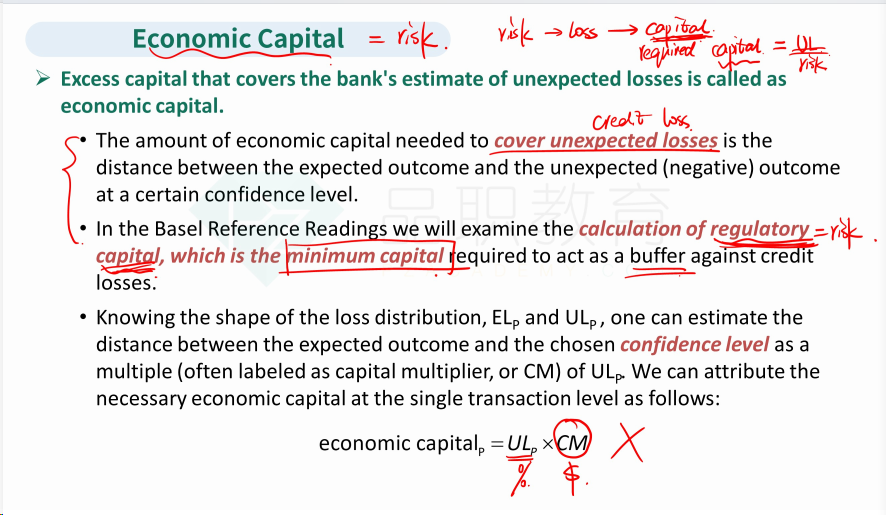

D is correct. Economic capital is distinguished from regulatory capital in that it considers correlations between credit, market, and operational risks. Regulatory capital requirements only require that the separate risks be added to come up with total capital requirements.

A is incorrect. As noted in A above, regulatory capital adds the separate capital calculations for credit, market, and operational risk to find total capital requirements.

B is incorrect. Both economic and regulatory capital would go up in that case.

C is incorrect. Both economic capital and regulatory capital act as a cushion that covers unexpected losses. Economic capital is the bank’s own estimate of the capital it should hold, while regulatory capital is the amount of capital regulators require it to hold.

Section: Valuation and Risk Models

Learning Objective:

Explain the distinctions between economic capital and regulatory capital and describe how economic capital is derived.

Reference: Global Association of Risk Professionals. Valuation and Risk Models. New York, NY: Pearson, 2022. Chapter 6. Measuring Credit Risk.

请问,这道题怎么做呢,没有很理解