NO.PZ2023071902000011

问题如下:

Question

A forex expert notices the following rates:

A riskless arbitrage profit exists that is closest to:

选项:

A.0.49%.

B.1.04%.

C.0.46%.

解释:

Solution

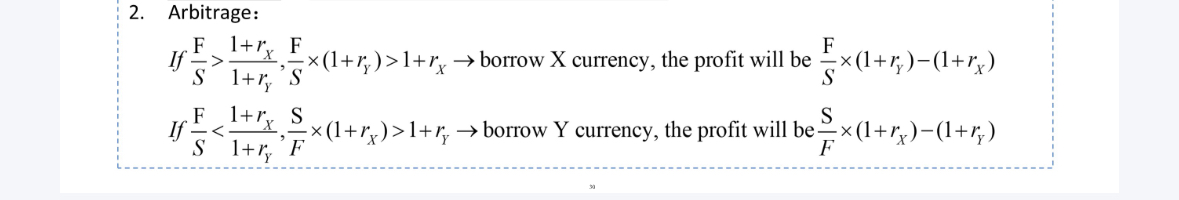

- The expert can secure a riskless arbitrage gain of 0.49%, determined as:

Return on the hedged foreign investment: Sf/d(1 + if)[1/Ff/d]-1 = 1.68(1.055)[1/1.72]-1 = 1.0246 -1= 3.05%.

Riskless arbitrage profit = Domestic risk-free rate – Return on the hedged foreign investment: 3.54% – 3.05% = 0.49%.

• explain the arbitrage relationship between spot and forward exchange rates and interest rates, calculate a forward rate using points or in percentage terms, and interpret a forward discount or premium

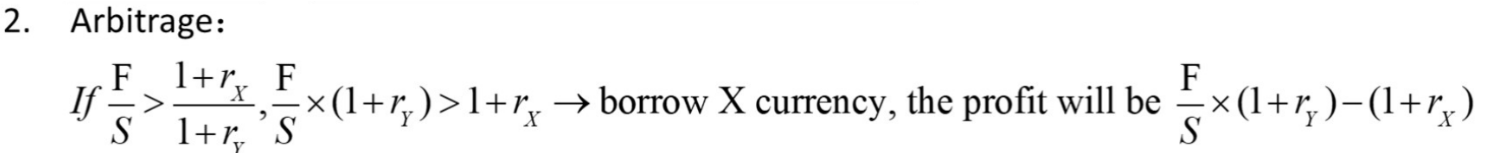

我用的(1.72/1.68)✖️(1+3.54%)-(1+5.5%)=0.5052

因为与答案略有差别,请老师看看公式是否正确