NO.PZ2019010402000030

问题如下:

A manager owns 500 shares of stock XYZ, the portfolio delta is 500, Deltac = 0.548, Deltap= -0.622. The manger could implement delta hedge by:

选项:

A.

selling 912 call options

B.

buying 912 call options

C.

selling 804 put options

解释:

A is correct.

考点:delta hedge

解析:

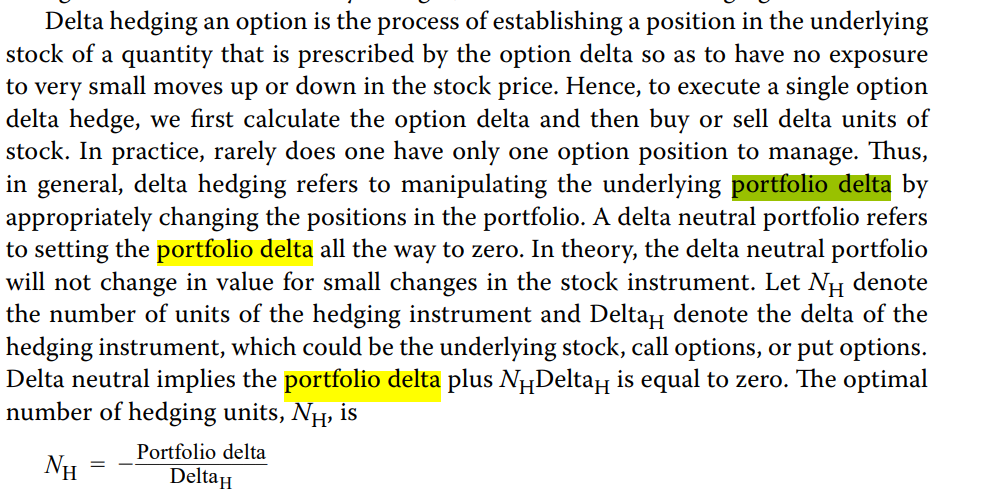

如果hedge工具是call,根据公式:

NH =- Portfolio delta/DeltaH =-500/0.548=-912,负号代表short,所以应该short 912 份call。

如果hedge工具是Put,根据公式:

NH =- Portfolio delta/DeltaH =-500/(-0.622)=804,正号代表long,所以应该long 804份put。

portfolio delta原版书有这个概念吗?还是品职自编的?原版书截图发一下谢谢