NO.PZ202206140600000204

问题如下:

Had the trade in the technology sector not occurred, the selection and interaction measure would have been closest to:选项:

A.0.35%. B.0.42%. C.1.23%.解释:

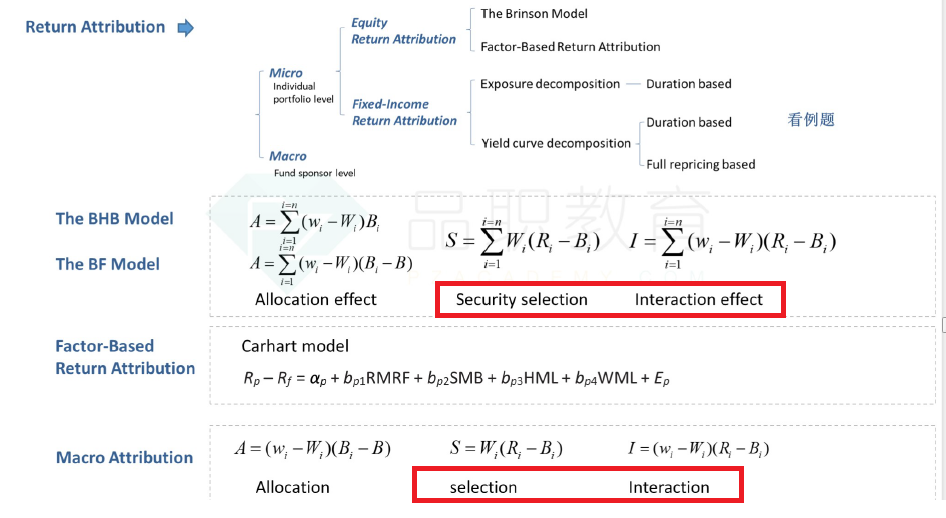

SolutionA is correct. The formula to determine selection and interaction is as follows:Selection + Interaction = Wi(Ri – Bi) + (wi – Wi)(Ri – Bi), where

Wi = Benchmark weight

Ri = Portfolio return

Bi = Benchmark return

wi = Portfolio weight

Selection + Interaction = (0.20)(0.1250 – 0.1109) + (0.25 – 0.20)(0.1250 – 0.1109)

= 0.0035, or 0.35%.

B is incorrect. This result would be generated by incorrectly using the portfolio weight as Wi in the selection measure calculation:

Selection + Interaction = Wi(Ri – Bi) + (wi – Wi)(Ri – Bi).

Selection + Interaction = (0.225)(0.1250 – 0.1109) + (0.25 – 0.20)(0.1250 – 0.1109)

= 0.0042, or 0.42%.

C is incorrect. This result would be generated by incorrectly using the original portfolio return as Ri and the revised portfolio return as Bi:

Selection + Interaction = Wi(Ri – Bi) + (wi – Wi)(Ri – Bi).

Selection + Interaction = (0.20)(0.1740 – 0.1250) + (0.25 – 0.20)(0.1740 – 0.1250)

= 0.0123, or 1.23%.

Without this trade, the portfolio’s technology sector return would have only been 12.50% 这句话是说benchmark return? 怎么看出来的