NO.PZ202207040100000502

问题如下:

Monica Popkirk Case Scenario

Monica Popkirk directs the equity manager selection team of PV-America Wealth Management (“PV”). She and her analysts evaluate, classify, and recommend funds to the PV investment committee. PV has asked Popkirk to broaden the selection of approved funds for its investment advisers to use in client portfolios and also to include some alternative asset classes by possibly using some hedge funds.

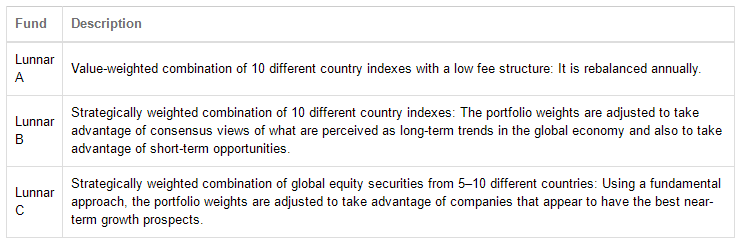

Popkirk and her team examine the fund descriptions and consider both holdings-based and returns-based approaches to style classification. Intending to select a top-down fundamentally driven manager, she considers three candidates from Lunnar Associates, as shown in Exhibit 1.

Exhibit 1

Lunnar Associates Funds under Consideration

Beyond the fund descriptions, Popkirk instructs her team to assemble an analysis table to help determine which of Lunnar’s funds has the closest fit to the style of its chosen benchmark index. She points out that all three of these funds are long only with well-known and accepted style box categories. Data are provided for both the holdings-based style analysis of the current portfolio and the returns-based style analysis based on 36 months of historical returns and are shown in Exhibit 2.

Exhibit 2

Lunnar Fund Style Analysis

Popkirk explains to her analysts that the better active fund managers wisely consider what pitfalls and behavioral biases may readily affect their strategies and those of their competitors. For instance, when evaluating the fundamental approach used by Lunnar C, Popkirk says that analysts should look for evidence that one of the following three biases have been acknowledged and addressed by the manager: survivorship bias, confirmation bias, or look-ahead bias.

Digging deeper into another one of Lunnar’s funds, Popkirk’s analysts review and discuss the Lunnar fund’s annual reports for the last six years. One of the reports noted, “During the last recession, we rotated into deep-value companies likely to deliver superior returns as a risk-on environment returned.”

The analysts then make the following comments:

Analyst 1: “The fund is following a top-down approach.”

Analyst 2: “I disagree. The emphasis on economic analysis is consistent with top down, but because it uses deep-value stocks, the approach is clearly bottom up.”

Analyst 3: “After reading the reports for all years, I was left thinking that overall they are GARP managers—growth at a reasonable price—which is top down.”

One of PV’s committee members has asked Popkirk for her thoughts as to which style classification should be used when describing Lunnar’s popular hedge fund, the Lunnar Hedge-X fund. It uses a variety of techniques to achieve alpha, including long–short equity portfolios with substantial futures and options overlays to control risk. Lunnar suggests its clients use a combination of the Lunnar Hedge-X fund along with its more traditional funds to improve the Sharpe ratio of its overall portfolios.

Boris Thompson, one of the Lunnar managers, claims to have had consistent success in beating his benchmark by using price momentum as a rewarded equity factor exposure. Popkirk warns her analysts that the manager may not be truly forthcoming regarding some periods of underperformance.

QuestionEvidence of which behavioral bias is most likely to be found when analyzing the Lunnar C fund?

选项:

A.Survivorship

B.Look-ahead

C.Confirmation

解释:

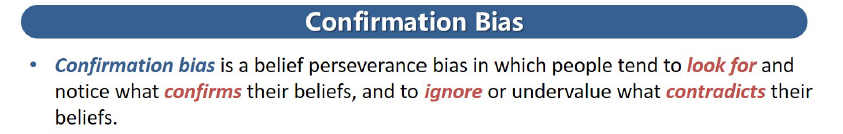

SolutionC is correct. Confirmation bias, a cognitive error sometimes referred to as “stock love bias,” is the tendency of fundamental-based analysts and investors to look for information that confirms their existing beliefs about their favorite companies and to ignore or undervalue any information that contradicts their existing beliefs. Both look-ahead bias and survivorship bias are risks inherent in backtesting quantitative active strategies.

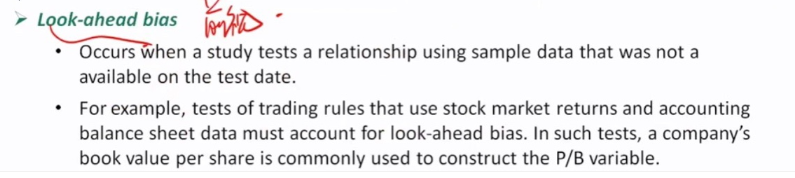

A is incorrect. Survivorship bias is a risk inherent in backtesting a quantitative active strategy. This approach creates a bias whereby only companies that have survived are tested and it is assumed that the strategy would never have invested in companies that have failed. Survivorship bias often leads to overly optimistic results and sometimes even causes investors to draw wrong conclusions.

B is incorrect. Look-ahead bias is a risk inherent in backtesting a quantitative active strategy. This bias results from using information that was unknown or unavailable at the time an investment decision was made. An example of this bias is the use of financial accounting data for a company at a point in time before the data were actually released by the company.

考点讲义帮忙截个图放上来吧,补充在回答里,谢谢