NO.PZ202207040100000303

问题如下:

Grasmere Asset Management Case Scenario

Morgan Abernathy, Nathaniel Granville, and Gabriella Carlucci are analysts at Grasmere Asset Management (Grasmere), an investment firm that offers a diversified mix of actively managed equity and fixed-income investment funds. The firm follows the fundamental approach, using both bottom-up and top-down investment management strategies. The analysts meet regularly to discuss investment ideas and related topics.

The meeting begins with a discussion of the fundamental approach to active equity management strategies. The analysts make the following statements:

The approach is a subjective investment process that uses discretion in making decisions.

The portfolio manager’s selections are based on determining a security’s exposure to selected variables that predict its return.

The construction of a portfolio is generally done using a portfolio optimizer, which controls risk at the portfolio level.

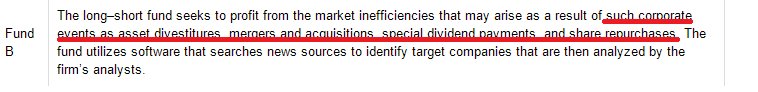

The analysts then review Exhibit 1, which describes a selection of the Grasmere equity funds.

Exhibit 1

Grasmere Equity Funds

The analysts made the following points about the potential investments that Fund B might undertake. The fund should be interested in

investing in the shares of a potential acquirer, even in a consolidating industry;

taking a control position in a distressed company’s shares selling at a deep discount to its intrinsic value; and

using its expertise to make long-term investments involving companies in reorganization.

Grasmere’s larger funds have had an impressive long-term record compared with peers. In more recent times, however, the results have been lagging. Positions have become more concentrated than in the past, and the proportion of positions underperforming their respective industries has increased. Carlucci believes managers may have become subject to two biases: an illusion of control and confirmation bias. Carlucci asks Abernathy what steps he could recommend to address the effect of these biases.

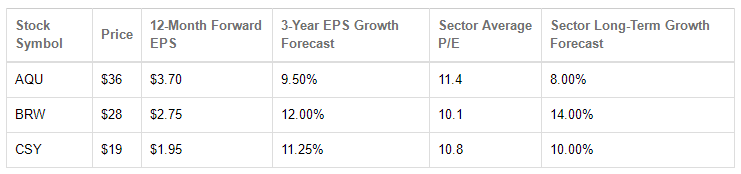

The final topic involves a discussion of some high-profile companies that recently released their full-year earnings results. Exhibit 2 contains market data and financial projections on three of the stocks discussed by Grasmere’s analysts. They are considering adding one of these stocks to Fund D.

Exhibit 2

Market Data and Financial Projections of Selected Stocks

Question

In the analysts’ discussion about Fund B’s potential investments, the point that is most accurate relates to:

选项:

A.reorganization opportunities.

B.positions in distressed companies.

C.acquisitions in a consolidating industry.

解释:

SolutionC is correct. Fund B fund seeks to profit from the market inefficiencies that may arise as a result of corporate events. It can hold either long or short positions in the acquiring and target companies as appropriate to produce a profitable position. This would be true even in consolidating industries as long as it believed that a market inefficiency existed.

A is incorrect. Fund B fund seeks to profit from the market inefficiencies that may arise as a result of corporate events. Investing in reorganizations requires skill and expertise but normally involves a long-term investment horizon, which is inconsistent with Fund B’s strategy.

B is incorrect. Fund B fund seeks to profit from the market inefficiencies that may arise as a result of corporate events. A control position in a distressed company would normally involve a long-term investment horizon, which is inconsistent with Fund B’s strategy.

可没讲是不是corporate event