NO.PZ202212260100003902

问题如下:

(2) Based on Exhibit 1, which country’s central bank is most likely to buy domestic bonds near term to sterilize the impact of money flows on domestic liquidity?

选项:

A.Country A B.Country B C.Country C解释:

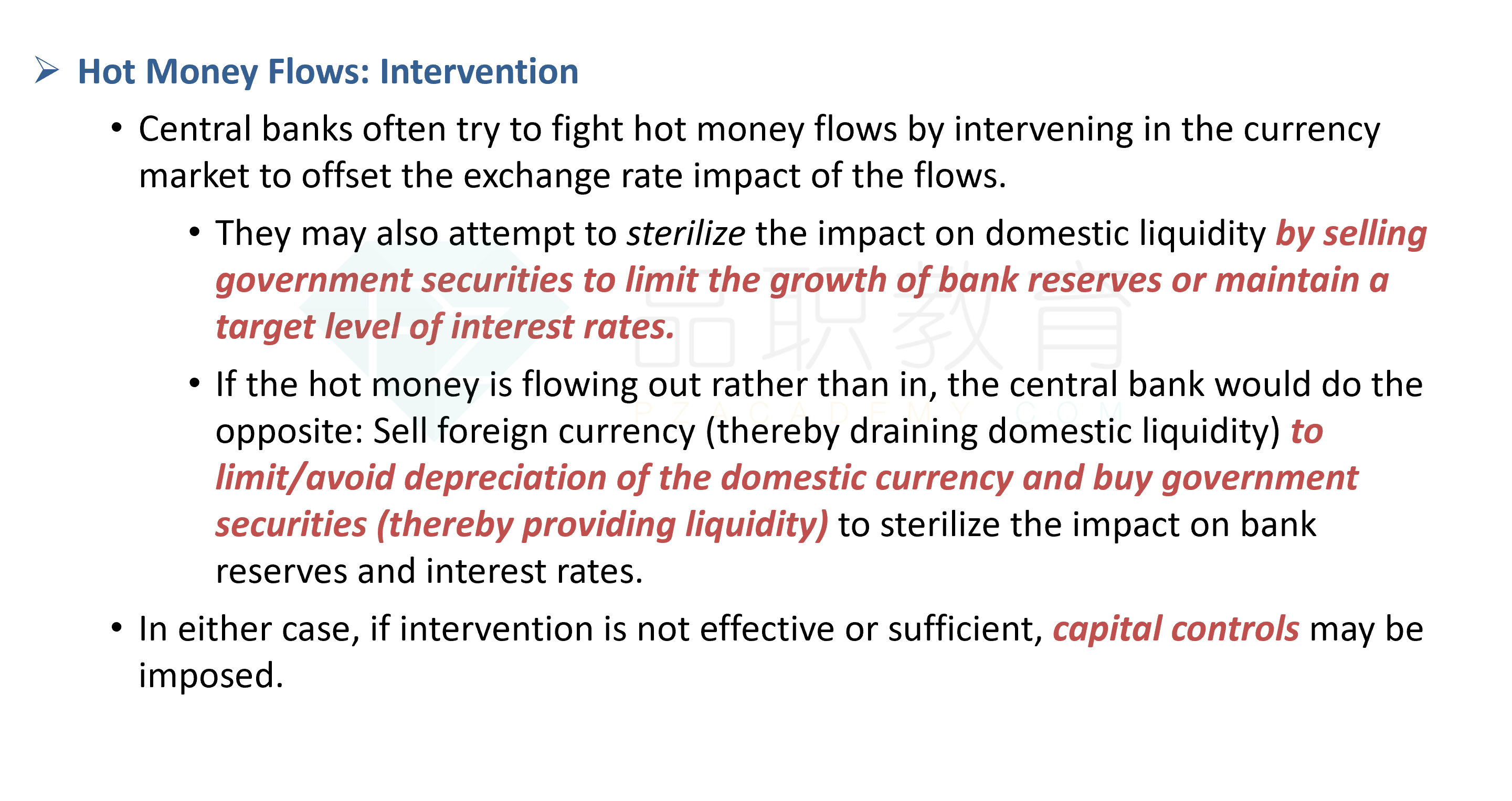

Hot money is flowing out of Country B; thus, Country B’s central bank is the most likely to sell foreign currency (thereby draining domestic liquidity) to limit/avoid depreciation of the domestic currency and buy government securities (thereby providing liquidity) to sterilize the impact on bank reserves and interest rates.

A is incorrect because Country A is not experiencing hot money flows and, therefore, would not need to sterilize the impact of money flows on domestic liquidity.

C is incorrect because hot money is flowing into Country C; thus, Country C’s central bank is most likely to sell government securities to limit the growth of bank reserves and/or maintain a target level of interest rates.

中文解析:

热钱从B国流出;因此,B国央行最有可能出售外币(从而抽走国内流动性)以限制/避免本币贬值,并购买政府证券(从而提供流动性)以冲销对银行储备和利率的影响。

A是不正确的,因为A国没有经历热钱流动,因此不需要冲销货币流动对国内流动性的影响。

C是不正确的,因为热钱正在流入C国;因此,C国央行最有可能出售政府证券,以限制银行储备的增长和/或维持目标利率水平。

这个是哪个知识点,在强化班哪页PPT上呢