NO.PZ2019100901000012

问题如下:

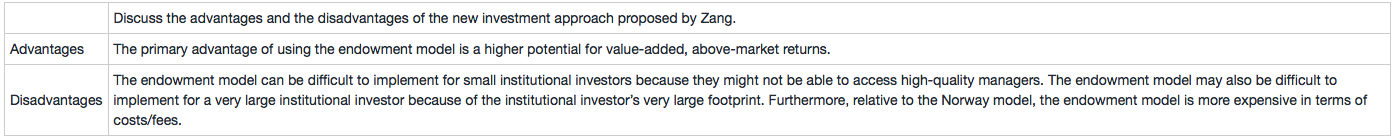

Bern Zang is the recently hired chief investment officer of the Janson University Endowment Investment Office. The Janson University Endowment Fund (the Fund) is based in the United States and has current assets under management of $12 billion. It has a long-term investment horizon and relatively low liquidity needs. The Fund is overseen by an Investment Committee consisting of board members for the Fund. The Investment Office is responsible for implementing the investment policy set by the Fund’s Investment Committee.

The Fund’s current investment approach includes an internally managed fund that holds mostly equities and fixed-income securities. It is largely passively managed with tight tracking error limits. The target asset allocation is 55% equities, 40% fixed income, and 5% alternatives. The Fund currently holds private real estate investments to meet its alternative investment allocation.

After a thorough internal review, Zang concludes that the current investment approach will result in a deterioration of the purchasing power of the Fund over time. He proposes a new, active management approach that will substantially decrease the allocation to publicly traded equities and fixed income in order to pursue a higher allocation to private investments. The management of the new investments will be outsourced.

选项:

解释:

题干中说明asset value is $12bn. 这个fund是large size.

那么在写disadvantage的时候还需要写出对small asset size 的 disadvantage么?

只写 对small asset size 的 disadvantage,不写对large asset size的disadvantage是否会扣分?