NO.PZ201712110200000409

问题如下:

Based on Exhibit 4 and Gillette’s forecast regarding Raffarin’s share price, the return on the RI bond over the next year is most likely to be:

选项:

A.lower than the return on Raffarin’s common shares.

B.the same as the return on Raffarin’s common shares.

C.higher than the return on Raffarin’s common shares.

解释:

A is correct.

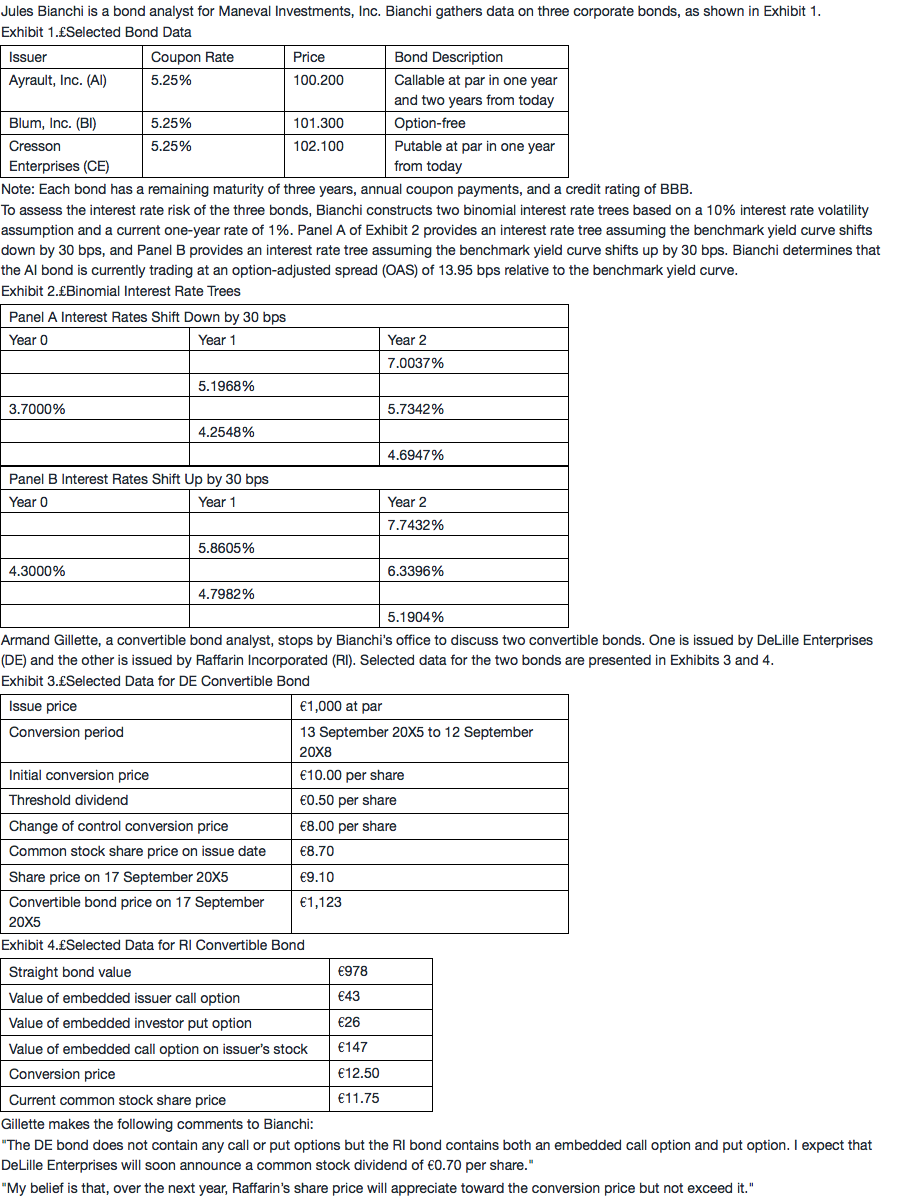

Over the next year, Gillette believes that Raffarin’s share price will continue to increase towards the conversion price but not exceed it. If Gillette’s forecast becomes true, the return on the RI bond will increase but at a lower rate than the increase in Raffarin’s share price because the conversion price is not expected to be reached.

视频讲解中提到,当股票价格向转换价格靠近时,可转债股性债性并存,处于一个涨跌幅均小于正股的情况,这个我可以理解。

那如果题目问:可转债当前out of money,正股价格预计继续下降,债相关的利率因素等不变,可转债价格应当如何变化?

假设答案给了【A.可转债价格会下降但幅度更小】【B.可转债价格不变】。这种情况下应该怎么选择?

是用“可转债out of money时偏债性,只受利率影响”的结论去选择B,还是用“可转债涨跌幅小于正股”的大原则去选择A?还请老师解惑。