NO.PZ202309050700000104

问题如下:

The level of debt that will maximize the value of Boulder Inc. is closest to:

选项:

A.$15 million.

$20 million

$30 million

解释:

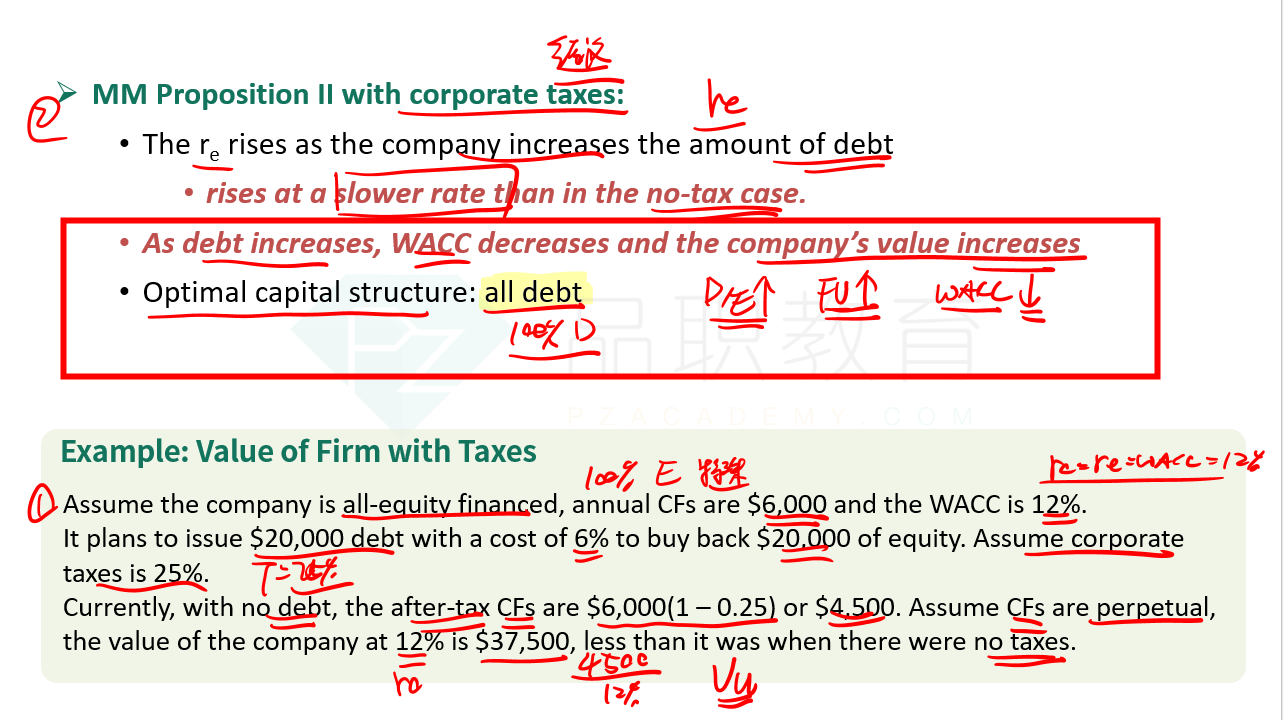

B is correct. With financial distress included, as debt is added to the capital structure, the levered value of the firm is given by:

VL = VU + tD − PV(Costs of financial distress).

The following shows calculations of the levered value of Boulder at various debt levels, in $millions.

Thus, the optimal amount of debt is $20 million, which maximizes the value of Boulder at a level of $49.5 million. Beyond $20 million in debt, greater leverage reduces the firm value because the present value of financial distress costs more than the offsetting tax benefit.

optimal capital structure 不是all debt吗