NO.PZ2021090805000022

问题如下:

John and his wealth advisor Bourne discuss investments.

Bourne described the differences between deterministic predictions and Monte Carlo simulations in investment plans and traditional and goal-based methods in constructing investment portfolios. After hearing about these methods, John stated that he believes that goal-based investment methods are most suitable for his needs because

it allows him to specify a level of risk tolerance for each goal,

growth toward each goal on a straight-line basis is much easier to understand, and

It provides the ability to predict the success probability of each goal.

John's most appropriate comment on his preference for goal-based investment methods is:

选项:

A.

risk tolerance.

B.

growth toward a goal.

C.

probability of success of a goal.

解释:

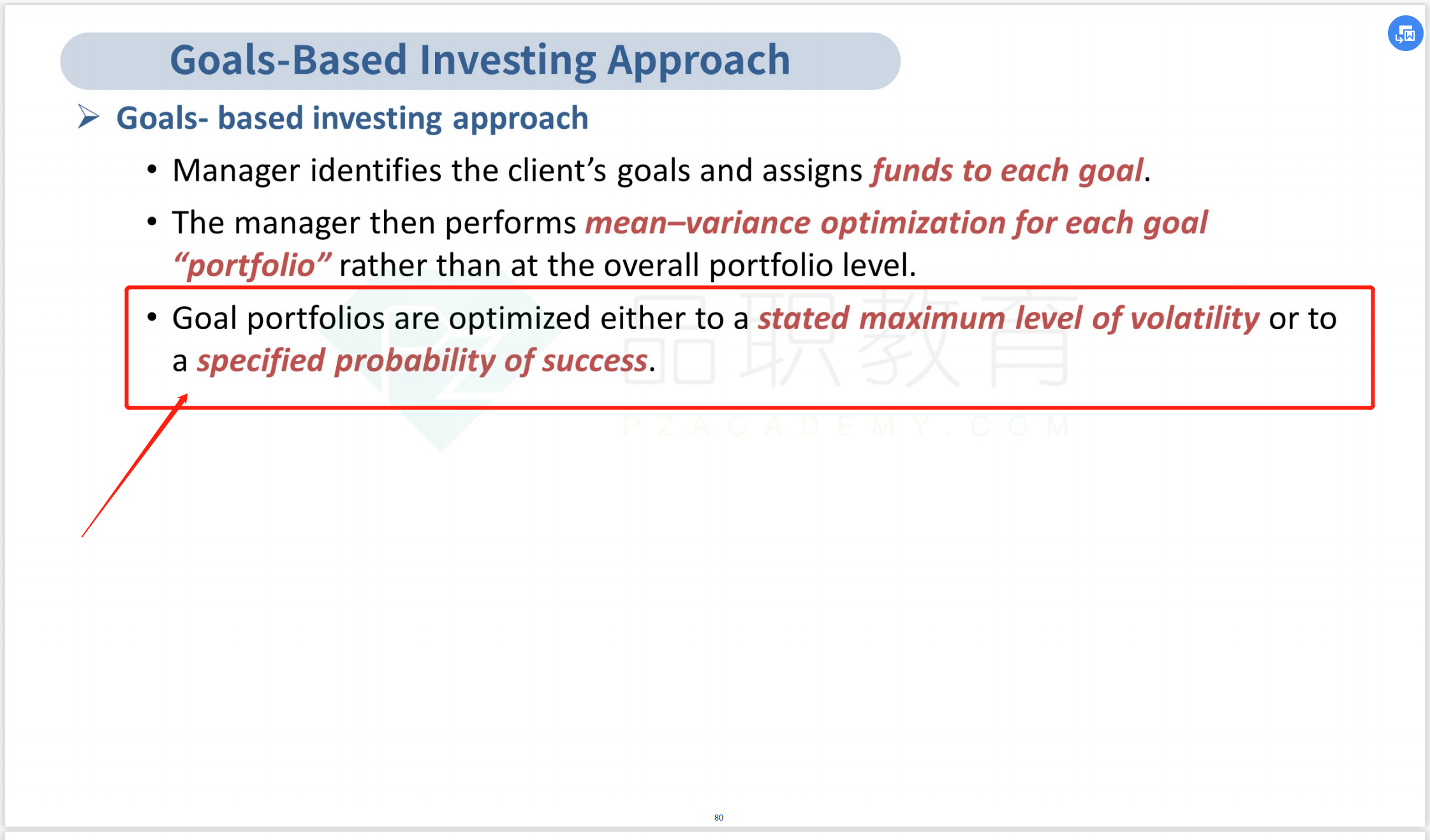

A is correct. Only the comments on risk tolerance specifically addresses goal-based investments, and his statement is correct.

B is incorrect. Straight-line growth is not a feature of goal-based investing; it is a component of the deterministic forecasting method for determining capital sufficiency in which a given return is assumed to compound until the investment horizon is reached.

C is incorrect. Probability of success is not a feature of goal-based investing; it is an outcome of the Monte Carlo method for determining capital sufficiency.

A是正确的。只有关于风险承受能力的评论专门针对基于目标的投资,他的说法是正确的。

B不正确。直线增长不是基于目标的投资的特征;它是确定资本充足性的确定性预测方法的一个组成部分,在该方法中,假设给定的回报率是复合的,直到达到投资期限。

C不正确。成功的概率不是基于目标的投资的特征;它是确定资本充足性的蒙特卡罗方法的结果。

讲义80页最后一句话什么意思