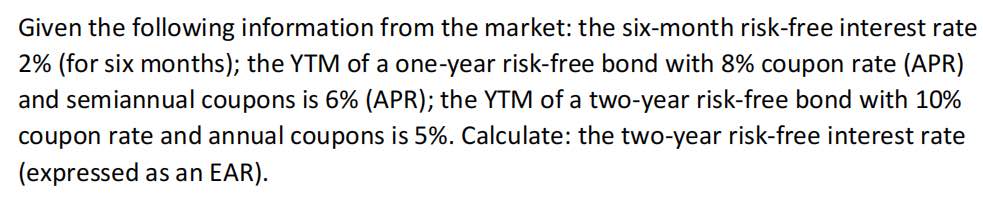

Given the following information from the market: the six-month risk-free interest rate 2% (for six months); the YTM of a one-year risk-free bond with 8% coupon rate (APR) and semiannual coupons is 6% (APR); the YTM of a two-year risk-free bond with 10% coupon rate and annual coupons is 5%. Calculate: the two-year risk-free interest rate (expressed as an EAR).