NO.PZ201909280100001101

问题如下:

Which asset class would best satisfy the Fund’s

diversification strategy?

选项:

A.

Private equity

B.

Private real estate

C.

Absolute return hedge fund

解释:

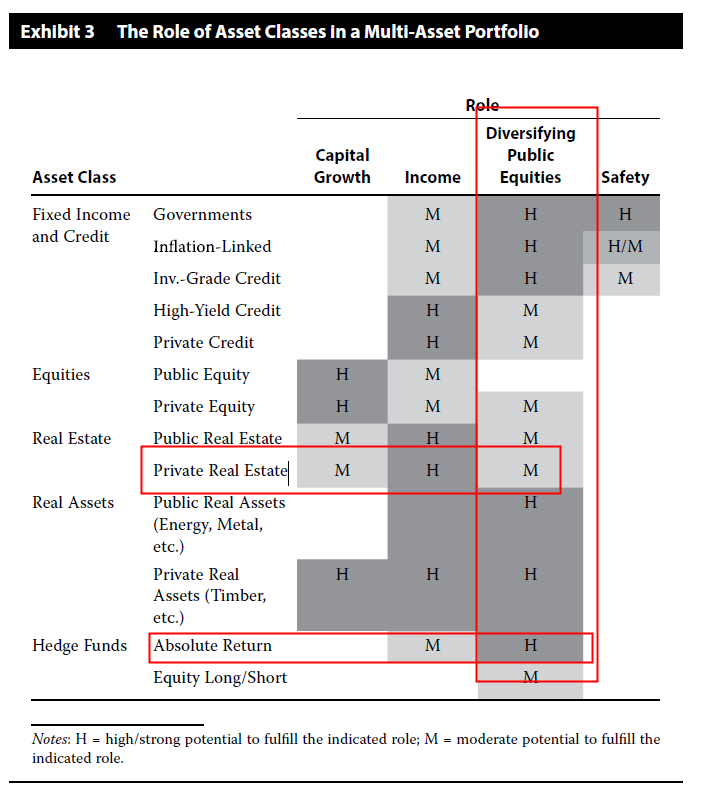

C is correct. An

absolute return hedge fund has a greater potential to diversify the fund’s dominant

public equity risk than either private equity or private real estate. Absolute

return hedge funds exhibit an equity beta that is often less than that of

private equity or private real estate. Also, absolute return hedge funds tend

to exhibit a high potential to diversify public equities, whereas equity

long/short hedge funds exhibit a moderate potential to fulfill this role.

A is incorrect

because although private equity provides moderate diversification against

public equity, an absolute return hedge fund has a greater potential to do so.

The primary advantage of private equity is capital growth.

B is incorrect

because private real estate provides only moderate diversification against

public equity, whereas absolute return hedge funds have a greater potential to

do so. The primary advantage of private real estate is income generation.

C是正确的。 与私募股权或私人房地产相比,An absolute return hedge fund在分散基金主要公共股权风险方面具有更大的潜力。 An absolute return hedge fund的股票贝塔系数通常低于私募股权或私人房地产的贝塔系数。 此外,An absolute return hedge fund在分散公开股票方面往往表现出很高的潜力,而股票多头/空头对冲基金则表现出适度的潜力来发挥这一作用。

A 是不正确的,因为尽管私募股权相对于公共股权提供适度的多元化,但An absolute return hedge fund有更大的潜力这样做。 私募股权的主要优势是资本增长。

B 是不正确的,因为私人房地产仅提供相对于公共股票的适度多元化,而An absolute return hedge fund有更大的潜力这样做。 私人房地产的主要优势是创收。

由于私人房地产和二级市场上的上市公司一样会受到一些宏观因素的影响(例如利率),所以只是部分的分散化的效果,但是分散化更好的主要还是Absolute return hedge fund,其β对冲掉了,基本只剩α的影响了,所以不受宏观因素的影响,使得其分散化更好。

讲义里好像没有这个知识点。但是他的贝塔没有了,好像跟 Market neutral那个策略很像,这两个是同一个东西吗?