NO.PZ2022090805000001

问题如下:

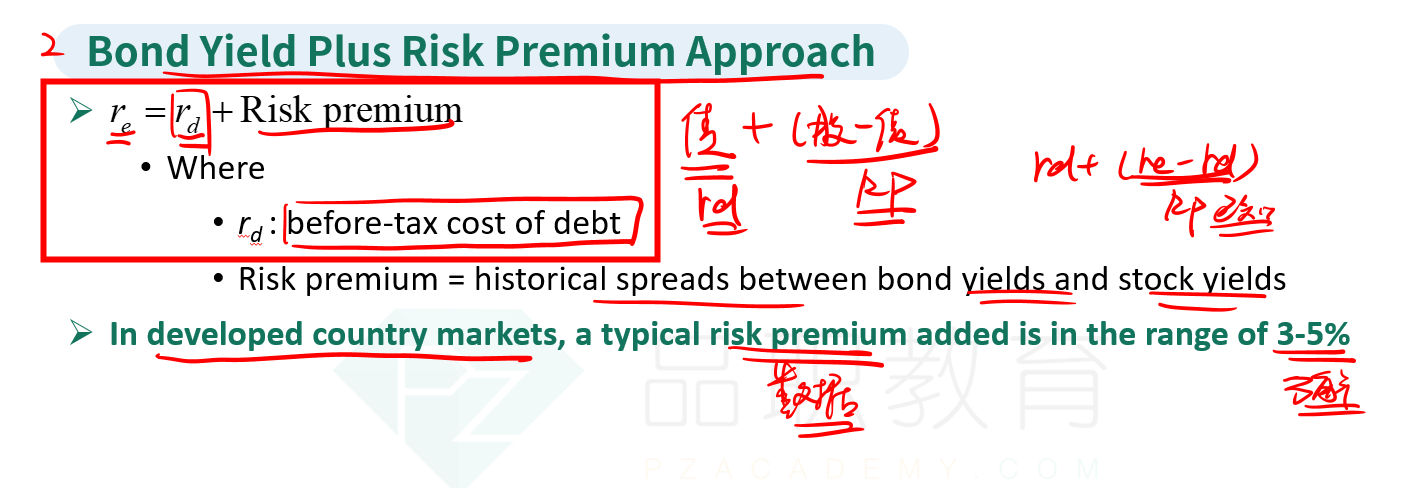

A 20-year $1,000 fixed-rate non-callable bond with 8% annual coupons currently sells for $1,105.94. Assuming a 30% marginal tax rate and an additional risk premium for equity relative to debt of 5%, the cost of equity using the bond-yield-plus-risk-premium approach is closest to:

选项:

A.9.90%

B.12.00%

C.13.00%

解释:

SolutionB is correct. First, determine the yield to maturity, which is the discount rate that sets the bond price to $1,105.94 and is equal to 7%. This calculation can be done with a financial calculator:

FV = –$1,000, PV = $1,105.94, N = 20, PMT = –$80, solve for i, which will equal 7%.

The bond-yield-plus-risk-premium approach is calculated by adding a risk premium to the cost of debt (i.e., the yield to maturity for the debt), making the cost of equity 12.00% (= 7% +5%).

A is incorrect because it uses the after-tax cost of debt: 9.90% = 7% × (1 – 30%) + 5%.

C is incorrect because it uses the coupon rate instead of the yield-to-maturity: 13.00% = 8% + 5%.

为什么不用将税率考虑在内?