想請教一下disposition effect和loss aversion的區別

王琛_品职助教 · 2023年08月25日

嗨,从没放弃的小努力你好:

1

disposition effect 可以理解为就是 loss-aversion,是一个意思

请参考原版书 P26 例题 4 的第一句话:"Loss-aversion bias, executed in practice as the disposition effect"

持有亏损的投资时间过长,而过早地卖出盈利的投资,请参考原版书 P26 Exhibit 3 上面一段的倒数第二句话

"the holding (not selling) of investments that have experienced losses (losers) too long, and the selling (not holding) of investments that have experienced gains (winners) too quickly."

2

考查题目:

2.1

课后题 R2 Behavioral Finance and Investment Processes 章节第 14 题

案例背景中提到,Blake 发现自己持有的头寸有相当大的损失,当证券下跌时,她不愿意卖出

"On several occasions, Blake has found herself holding positions with sizable losses and she has been reluctant to sell when a security declines."

这句话体现出 disposition effect,所以不选

2.2

真题-2015-11-A

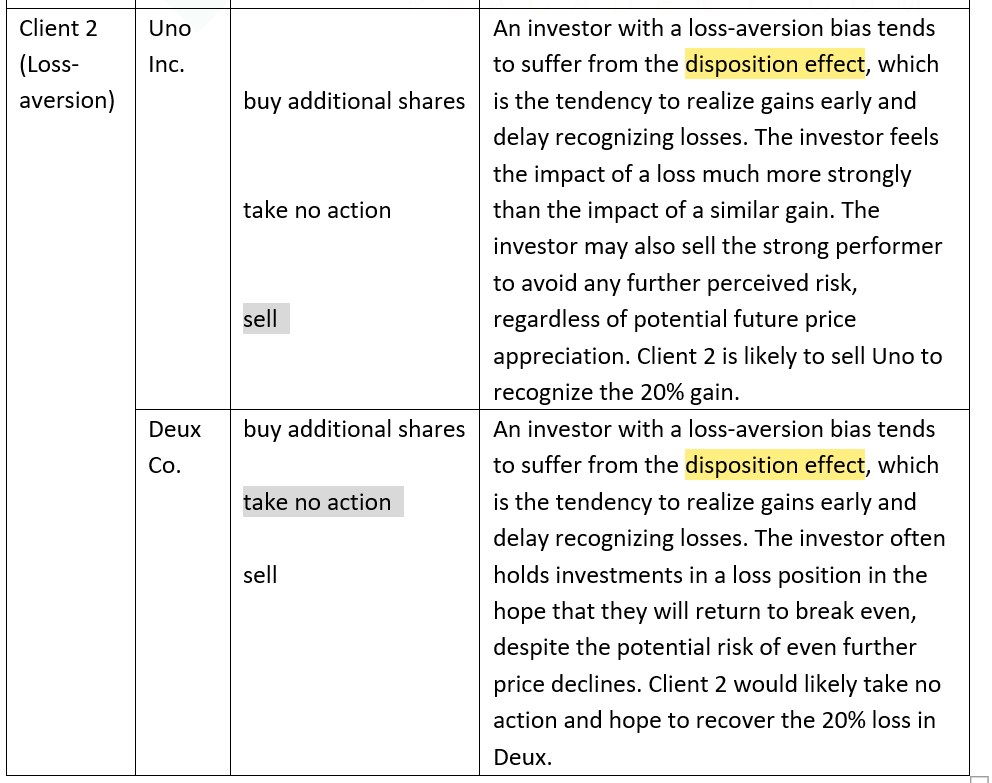

收录于经典题 R1 The Behavioral Biases of Individuals 章节的 3.3 题,其实考查的是 loss-aversion,协会在解析的参考答案中,提到了 disposition effect,可以参考一下

----------------------------------------------就算太阳没有迎着我们而来,我们正在朝着它而去,加油!

rebecca222333 · 2023年08月25日

謝謝!