NO.PZ202110280100000401

问题如下:

Identify the likely appropriate price benchmark for the LIM trade. Justify your response.

选项:

解释:

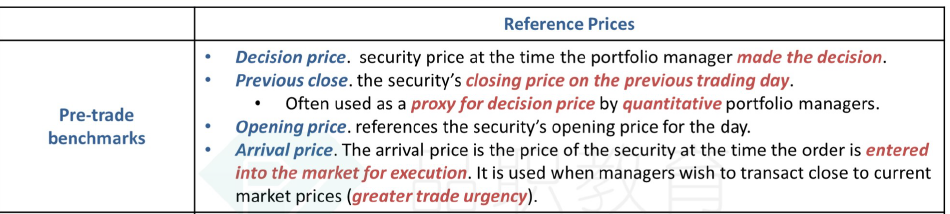

A pre-trade benchmark is a reference price that is known before the start of the period over which trading will take place. For example, pre-trade benchmarks include decision price, previous close, opening price, and arrival price. A pre-trade benchmark is often specified by portfolio managers who are buying or selling securities on the basis of decision prices. In this case, Bradley’s target price had been set based on his valuation principles before the opening, whereas waiting for the other benchmarks as inputs would result in the perceived opportunity expiring before it could be exploited.

For Bradley and his trader, two of these pre-trade benchmarks are potentially appropriate. Those are either the decision price, which was the price when Bradley made the decision to buy or sell the security, or the arrival price, which is the price of the security at the time the order is entered into the market for execution. Portfolio managers who are buying or selling on the basis of alpha expectations or a current market mispricing will often specify an arrival price benchmark.

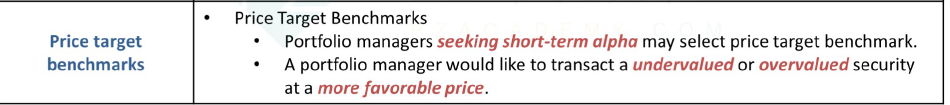

怎么区分PRE TRADE 和 PRICE TARGET,感觉这道题两个都适合。