NO.PZ2020021203000098

问题如下:

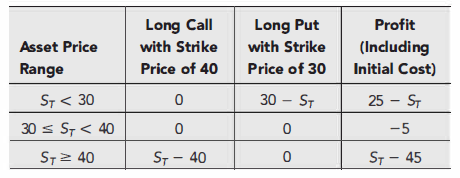

A call option with a strike price of USD 40 costs USD 2 and a put option with a strike price of USD 30 costs USD 3. Both have the same time to maturity. Explain how a strangle can be created using these options, and construct a table showing the profit as a function of the asset price at option maturity.

解释:

St >40 的时候call那栏写的是st-40,应该跟最后一项一致是st-45吧,st-40没有把call和put的成本算进去。